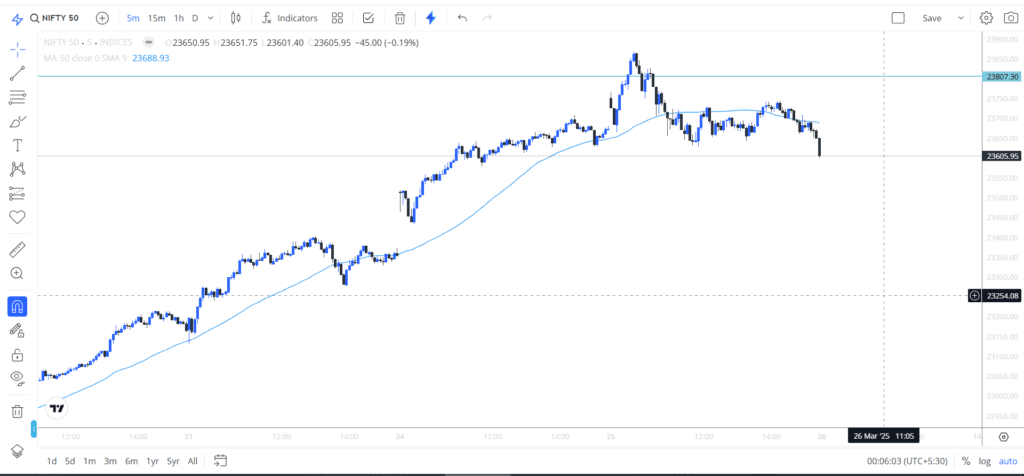

A positive FII flow, along with a strengthening INR against the USD and a muted global outlook, supported the market once again, pushing it even higher than the previous level. Today, the market reached a crucial price level that we have repeatedly discussed in our previous blogs of Trade setup, emphasizing its significance in the coming times.

Although the market touched this level, it did not close at it as it had on earlier days. Over the past six trading sessions, the market consistently closed in the green, with each session ending near the day’s high, leading to a positive start the following day. However, today, the market did not follow the same pattern.

The market opened with a gap-up today compared to the previous session. A similar pattern occurred, creating some initial pressure. However, after the first two 5-minute candles, the market made a strong rebound, generating a robust 200-point movement within the next three 5-minute candles, ranging between 26,660 and 28,860. This surge strengthened the market further.

Despite this, selling pressure emerged from higher levels, particularly around 28,600, which has been a crucial resistance. As a result, the market faced resistance and, after approaching the 26,670 level, entered a choppy phase. It remained near that level throughout the day and eventually closed at 23,605.

Global market analysis for Trade setup

A major statement has come from the White House, confirming that Russia and Ukraine have agreed to a Black Sea ceasefire. Additionally, reports suggest that the U.S. has also agreed to a ceasefire concerning energy infrastructure, a move that was confirmed by Putin after his conversation with Trump earlier.

Both sides have now issued official statements. Russia has set conditions for an immediate ceasefire, including the removal of sanctions on banks, insurers, and food exporters. Meanwhile, President Zelensky stated that it is too positive to draw conclusions, emphasizing that they will closely monitor the situation to ensure that Russia does not violate the terms of the ceasefire.

Yesterday, NASDAQ made a strong move and closed near its high. Today, it opened near the same level and initially bounced to the upside. However, it is now facing selling pressure from higher levels.

The key focus will be on how the U.S. administration handles reciprocal tariffs. Reports suggest that the Trump administration is planning a two-step approach to implementing tariffs in the near future. It remains to be seen how this will play out and impact the market.

Domestic market analysis for Trade setup

The market continues to surge as positive inflows from FIIs support the rally. Some analysts are questioning whether this rally can be sustained. However, as we have discussed before, it is likely to continue since it is primarily driven by banks and financial services stocks, which have strong domestic businesses. Additionally, FIIs are showing a positive outlook toward this trend.

On the other hand, the IT sector is under pressure due to its significant exposure to the U.S. market. In a recent meeting, Accenture stated that 8% of its contracts are linked to the U.S. Federal Reserve, making it vulnerable to potential cuts in U.S. aid projects. This could impact the sector moving forward. However, no major comments have been made by key IT firms regarding this situation yet, so it remains to be seen how things unfold.

Meanwhile, IT stocks have already corrected significantly, dropping nearly 20-25% from their recent highs.

A key observation here is that Nifty has surged nearly 9% this month. However, despite making a strong move yesterday, India VIX also jumped by 9%, raising concerns. This rise in volatility impacted today’s session, keeping Nifty flat even amid FII buying.

Another notable development is that NASDAQ’s mid-cap and small-cap stocks closed lower today, with small caps declining by 1.5% and mid-caps falling nearly 1%.

Regarding the Trump-2 tariff war, reports from West Nile suggest that Indian exports may benefit if the U.S. imposes tariffs on India. Additionally, an important statement has come from the SBA, indicating that India is not facing significant financial distress due to these tariffs.

According to their assessment, India’s exports could see fluctuations of around 3% to 7%, which is not a major impact and remains within an acceptable range.

FII & DII activity and Option chain analysis

FII & DII activity

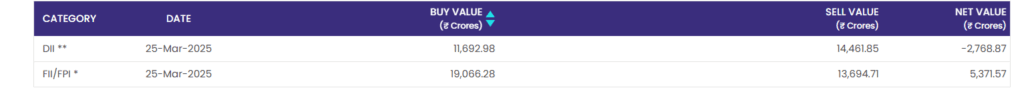

Foreign Institutional Investors (FIIs) have invested nearly ₹23,000 crores in the Indian equity market over the last seven sessions, driving a strong rally that has pushed NIFTY up by nearly 2,000 points. Despite this significant surge, FIIs continue to buy in the Indian market, creating a wave of optimism and boosting confidence among retail traders.

This rally is primarily led by banking stocks, which hold strong fundamental value. As a result, traders are now considering the possibility of market stability in the coming sessions, with little likelihood of a sharp correction similar to previous ones.

In today’s session, FIIs bought nearly ₹5,371 crores, while Domestic Institutional Investors (DIIs) sold around ₹2,768 crores. This continued FII support has further strengthened market sentiment.

This version improves clarity and flow while keeping your insights intact. Let me know if you’d like any further refinements!

As we discussed earlier, this month has been crucial from the perspective of FIIs. So far, FIIs remain net sellers in March, with an outflow of nearly ₹7,000 crores. With only three trading sessions left, the key question is whether FIIs will turn net positive by the end of the month.

The last time FIIs became net buyers for a full month was in September, after which the market experienced a decline as FIIs shifted their stance and contributed to the downturn.

The next three days will be crucial in determining whether FIIs end the month on a positive or negative note, which could significantly impact market sentiment going forward.

Option chain analysis for Trade setup

In our previous option chain analysis, we observed that call writers lacked confidence in writing calls for the near term. The 24,000 level had witnessed one of the highest call writings in that analysis.

However, in today’s session, the formation of a Doji candle on the daily timeframe has shifted the focus to 23,800 as a crucial resistance level, where we now see 1,12,251 open contracts by call writers. Additionally, the 23,700 level has also seen significant call writing, with approximately 95,000 contracts.

On the support side, 23,500 has emerged as a strong support level with 8,00,000 open contracts. Beyond this level, there is no major support similar to the levels where call writers are active.

Based on the current option chain analysis, 23,800 is likely to act as a strong resistance, while 23,500 remains a key support for the near term.

Nifty 50 prediction

Today, we reached the key level of 23,800, which we have been discussing for the past four days. Our analysis indicated that 23,800 would be a crucial level, either as a trend-changing point or a trend-respecting level. As expected, the market treated this level as a resistance zone, leading to profit booking during today’s session.

Looking ahead, 23,800 has formed a Doji candle on the daily chart, which is significant because a Doji often signals potential trend reversal or indecision in the market. However, to confirm any major trend shift, we also need to analyse global cues.

Conclusion

Currently, global factors such as the ongoing Russia-Ukraine ceasefire talks and U.S. tariff developments are playing a role in shaping market sentiment. Reports suggest that the reciprocal tariffs being imposed globally are unlikely to have a significant negative impact on Indian companies.

We have been discussing the 23,800 level for the past four days, and today, the market touched this level but failed to close above it. The key question now is whether this level will sustain or not.

Currently, this level seems unstable as the market reached it with a sudden movement. However, if FIIs continue their buying momentum as they have been doing, then in the next 10 to 12 days, we may see this level turning into a sustainable support zone with stronger nearby support.

1 thought on “Trade setup for 26 march; Nifty prediction- 23800, Russia- Ukraine ceasefire, FII net buyer in march”