Infosys is one of the leading IT companies in India, second only to TCS in terms of market capitalization and global presence. It has established a strong foothold in the US, Europe, and other international markets, providing IT consulting, digital transformation, and outsourcing services. Its focus on AI, cloud computing, and automation has helped it maintain competitiveness in the rapidly evolving tech industry.

Infosys is considered the second major IT company in India. It has a strong global presence, dominating the market in the USA, Europe, and other parts of the world.

We often hear in the news that fears of a U.S. recession lead to a decline in the Indian IT sector, which in turn affects the overall market. Such reports are common. Additionally, news about rising inflation or weak GDP data in the U.S. frequently surfaces, and these factors directly impact the Indian IT sector.

Infosys is India’s second major IT company, with a strong global presence and a significant business in the US and Europe. It generates substantial revenue by providing services to companies in these regions.

How Infosys make money

Simply put, I have a company, but my business currently operates offline. Now, I want to take it online. To do this, I need a website, visitor data, and a way to showcase my products on the site. Infosys provides these services, helping businesses establish and manage their online presence.

To run a successful business, I also need my product to be updated regularly and allow for necessary changes. Additionally, if I want any modifications to my website or product, they should be available at all times. Infosys provides these services to companies, which is known as software services—one of its major revenue sources.

In this case, the company needs quality IT services on a regular basis. It’s not just about creating a product; continuous updates and upgrades are necessary as newer technologies emerge. Additionally, if there is a surge in traffic, the system must handle it efficiently. This is why Infosys establishes long-term contracts with such companies. As a result, Infosys maintains stable revenue due to its agreements and partnerships with numerous clients worldwide.

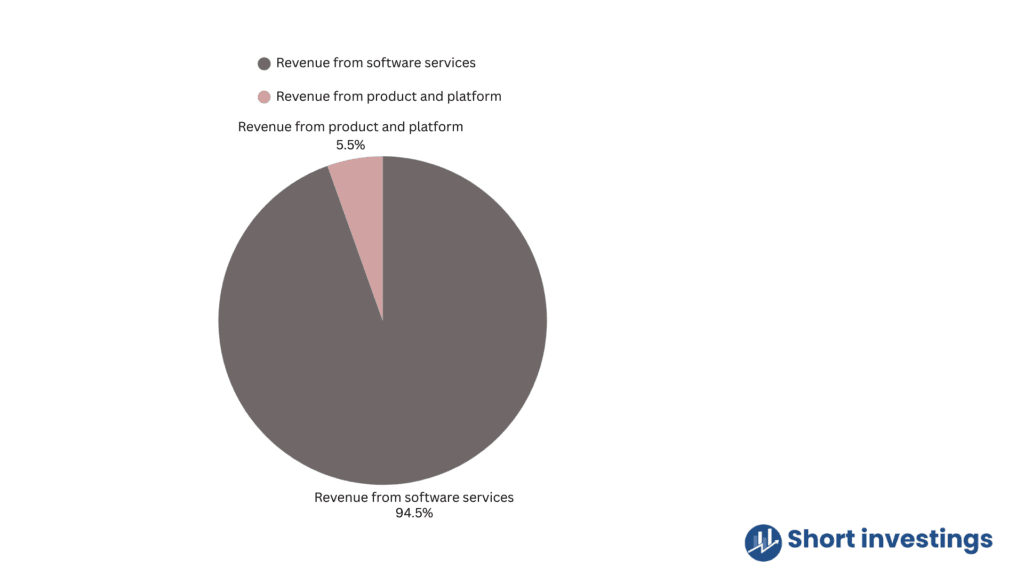

Infosys generates revenue in two ways: through software services and product sales. As explained earlier, software services involve long-term contracts with clients. However, another revenue stream comes from selling products. Infosys develops websites or applications and then sells these applications to multiple clients, often using the same underlying framework or pattern. This can be considered a form of intellectual property, allowing them to generate revenue from product sales.

The majority of Infosys’ revenue comes from software solutions, while a smaller portion is generated through products and platform-based services.

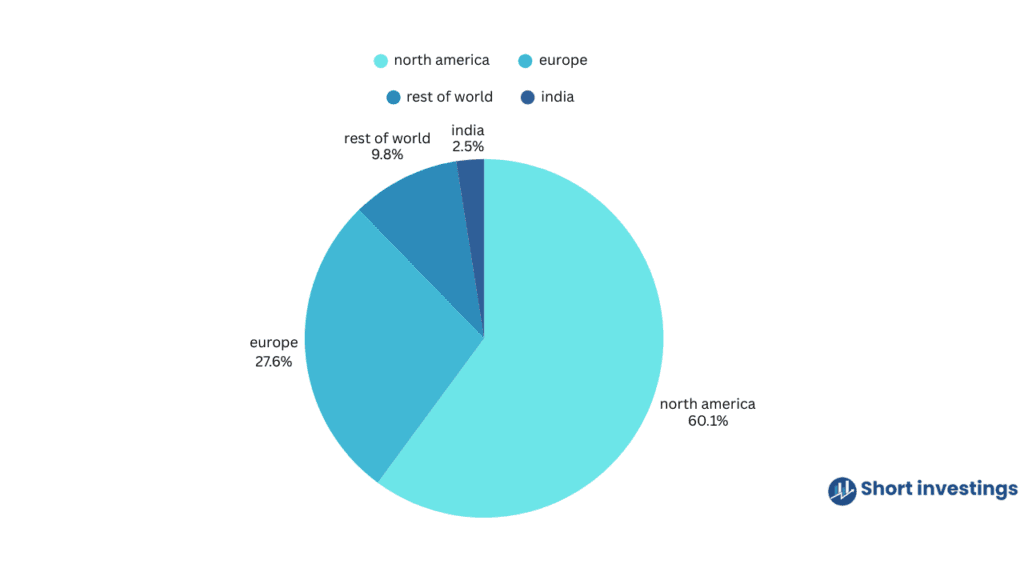

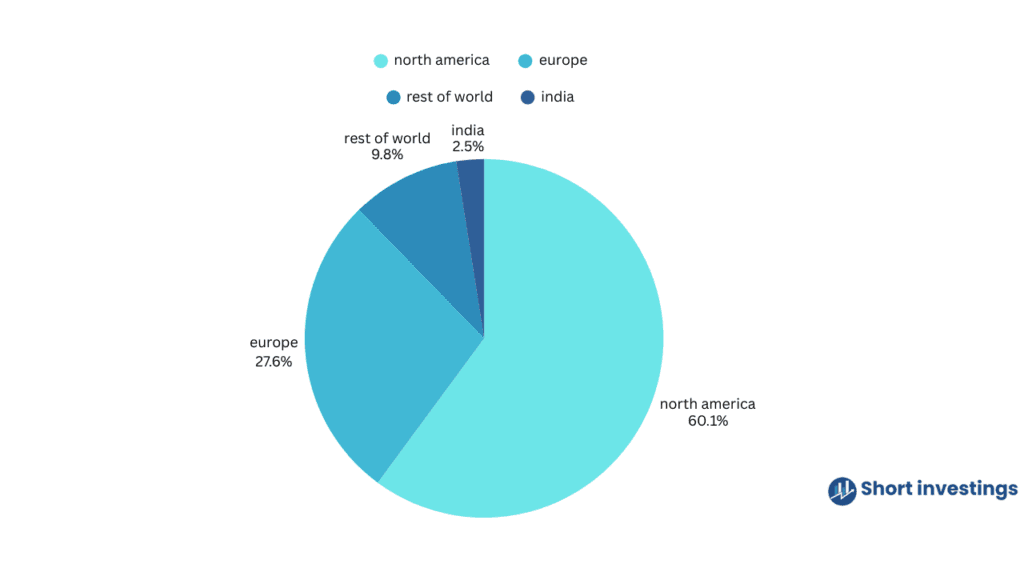

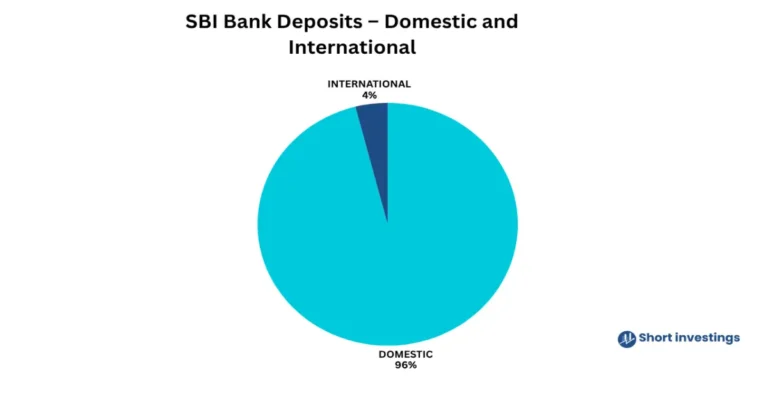

When looking at revenue by geography, North America alone contributes around 60% of Infosys’ revenue, while Europe accounts for nearly 28%. The rest of the world brings in approximately 9.8%, and India contributes just 2.5%. This highlights how crucial the global economy is for companies like Infosys.

It’s important to understand why Europe and America matter for companies like Infosys—nearly 90% of its business comes from these two continents. This makes it crucial to monitor factors like inflation, GDP data, and geopolitical events, as they directly or indirectly impact Infosys’ business and overall market stability.

Infosys expenses

When looking at Infosys’ expenses, nearly 54% goes toward employee costs. Once the products and services are established, employees are responsible for managing and maintaining them, making labor a significant and consistent expense. The remaining costs are relatively smaller in comparison.

Also read; CDSL Business Model; 6 major sources of revenue, Expenses, Risk and challenges

Positive factor for the Infosys business model

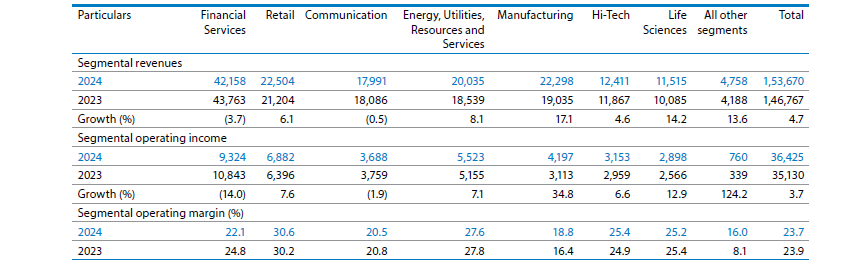

A key positive factor in Infosys’ business model is its impressive profit margin of around 24%. This is a strong indicator of financial health, allowing the company to generate solid results, maintain stability, and create better growth opportunities for the future.

How Sustainable Is Infosys’ Business?

Over the past two years, the economies of the US and Europe have faced challenges due to factors like the Russia-Ukraine war, post-COVID policy impacts, and demographic shifts. Despite these economic hurdles, Infosys has not experienced a year-on-year decline in revenue or significant drops in quarterly results. This highlights the resilience and effectiveness of its business model.

Even during tough economic phases, Infosys has maintained stability, demonstrating why IT giants like Infosys are considered strong investment opportunities. Their business model ensures consistent revenue, making them attractive for long-term investment and trading.

Future Outlook for Infosys

One of the biggest strengths of Infosys lies in the future of technology. Today, every business is moving online, following the idea that “if your business is not online, you are not in business.” This shift directly benefits the IT sector, including giants like Infosys.

Looking ahead, emerging technologies such as AI, cloud computing, and automation are becoming essential for businesses aiming for long-term success. Companies investing in these technologies will need strong IT support, which positions Infosys for sustained growth.

Additionally, a report from NALCOM suggests that AI is expected to grow at a double-digit rate in the near future. This further strengthens the long-term prospects for Infosys, making it a solid player in the evolving digital landscape.

Potential Risks for Infosys

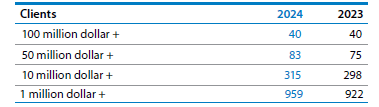

While Infosys has a strong business model, there are some concerns to consider. One major risk is its client dependency. Around 13.3% of Infosys’ revenue comes from its top five customers, and nearly 20% comes from its top ten clients.

This creates a reliance on a few key clients. If any of them face financial difficulties or switch to competitors, it could significantly impact Infosys’ revenue. Additionally, if rivals manage to secure these deals, it could make Infosys’ business more complicated and pose risks for investors.

Another important point is that Infosys’ performance is closely linked to the economic conditions of the US and Europe. Any developments, such as the Russia-Ukraine war, geopolitical tensions, or economic instability in these regions, can negatively impact Infosys.

For example, if there are financial scams, economic slowdowns, or unexpected events that hurt the US economy, it will directly or indirectly affect companies like Infosys. Therefore, it is important for investors to closely monitor the situation in the US and Europe, as these factors play a significant role in shaping the business environment for Infosys.

7 thoughts on “Infosys business model; How Infosys make money, expenses, Potential risk and future outlook”