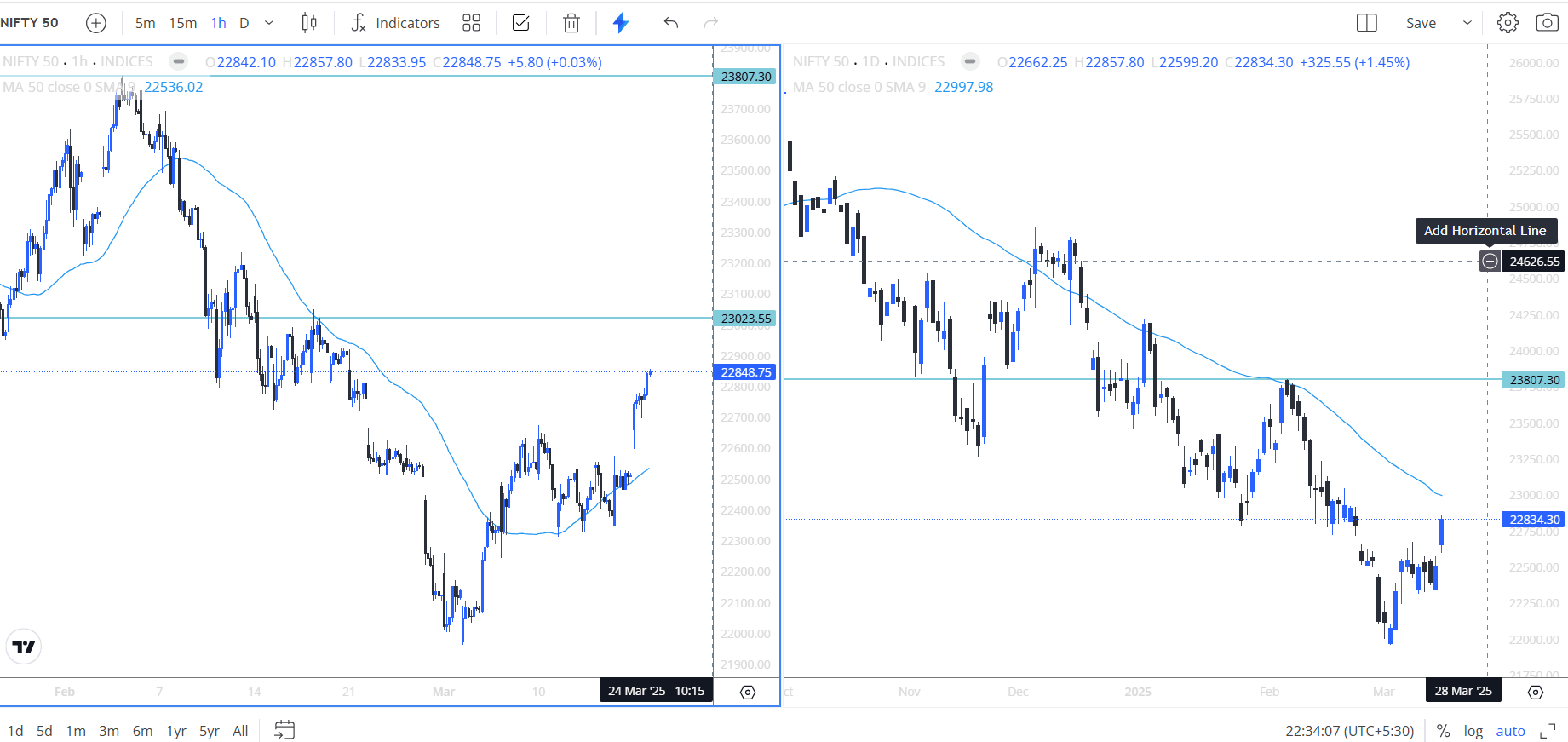

The market made a spectacular movement today, gaining 325 points in a single day. This is a very positive moment as it has surpassed the 22,600 level and closed above 22,800, making the trade setup for tomorrow relatively easier. It has been nearly a month since Nifty last closed near the 22,800 level, making it crucial to see how the market will perform further. From a technical perspective, a key test level for Nifty 50 is emerging around 23,000.

The market started with nearly a 100-point upside before pulling back to test lower levels. After a brief consolidation, it made a strong bounce back with significant movement over the next two hours. Nifty also attempted a retest at the 22,680 level before rebounding strongly. After this, Nifty showed no signs of weakness and closed near the day’s high.

Global Market Analysis

Several global factors influenced today’s market rally. One key factor is the Russia-Ukraine war, which appears to be taking a positive turn. The Ukrainian foreign ministry has decided to take the outcomes of the Jeddah meeting positively regarding a future ceasefire. Additionally, Russian President Vladimir Putin has agreed to consider negotiations, signaling a more constructive approach. Moreover, Russia has expressed willingness to engage with the European Union and has requested Western nations to halt defense equipment supplies to Ukraine.

Another factor is U.S. inflation, which stands at approximately 2.9% for the year. This raises concerns regarding the Federal Reserve’s 2% target, making tomorrow’s trade setup crucial.

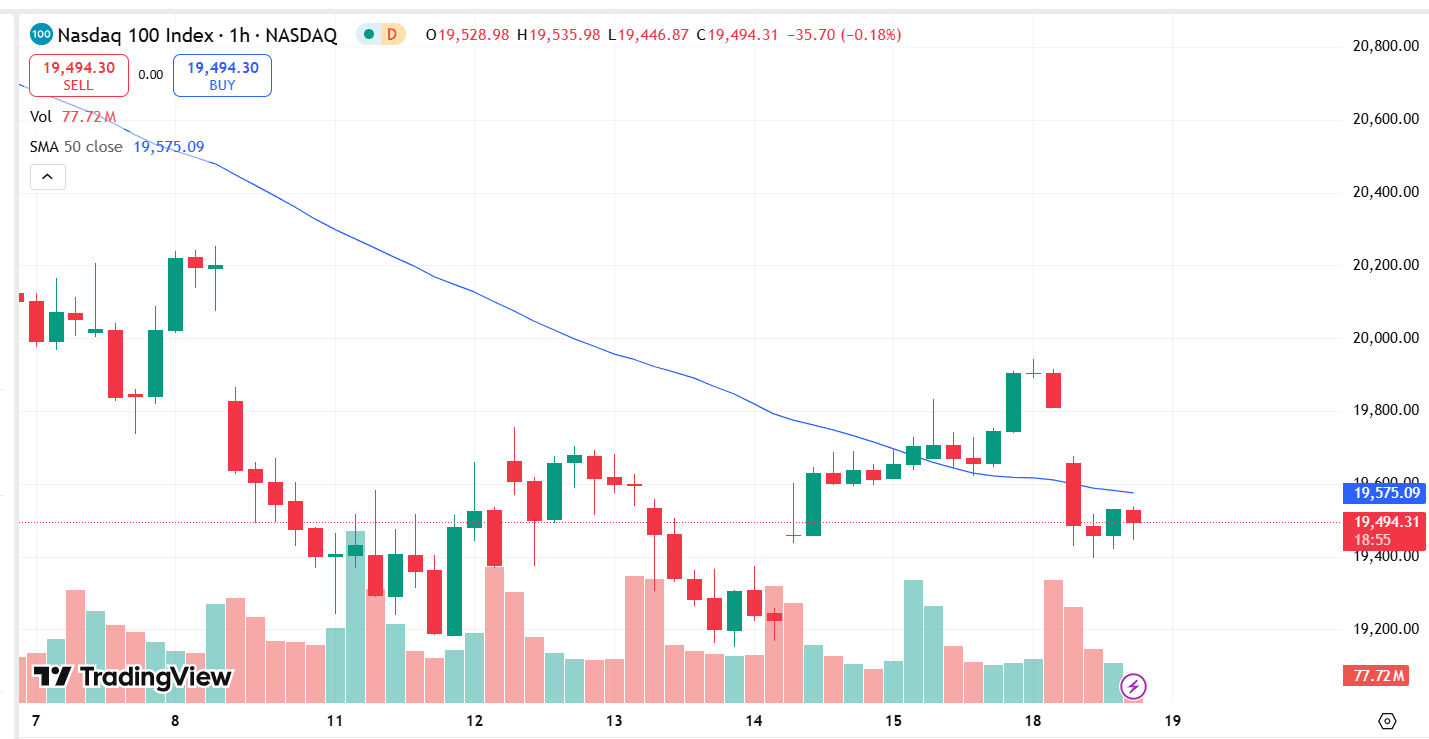

Meanwhile, the U.S. market showed signs of caution ahead of the Fed policy outcome. The Nasdaq declined from the previous day’s close, affecting the IT sector. Any significant developments in the U.S. economy tend to have a direct impact on India’s IT sector.

FII & DII Activity and Derivative Market

FII & DII Activity

Foreign Institutional Investors (FII) played a significant role in today’s market movement, with Nifty closing over 300 points higher. FIIs were net buyers, purchasing stocks worth over ₹695 crore in the Indian cash market. Meanwhile, Domestic Institutional Investors (DII) bought nearly ₹2,000 crore worth of equities, providing strong support to the market.

Notably, this was the first time in March that FIIs turned positive at the end of the day in the Indian cash market. However, it will be crucial to see how the market reacts tomorrow, as FIIs have previously turned net sellers after brief buying periods. Monitoring FII activity will be essential in the coming sessions.

Derivative Market

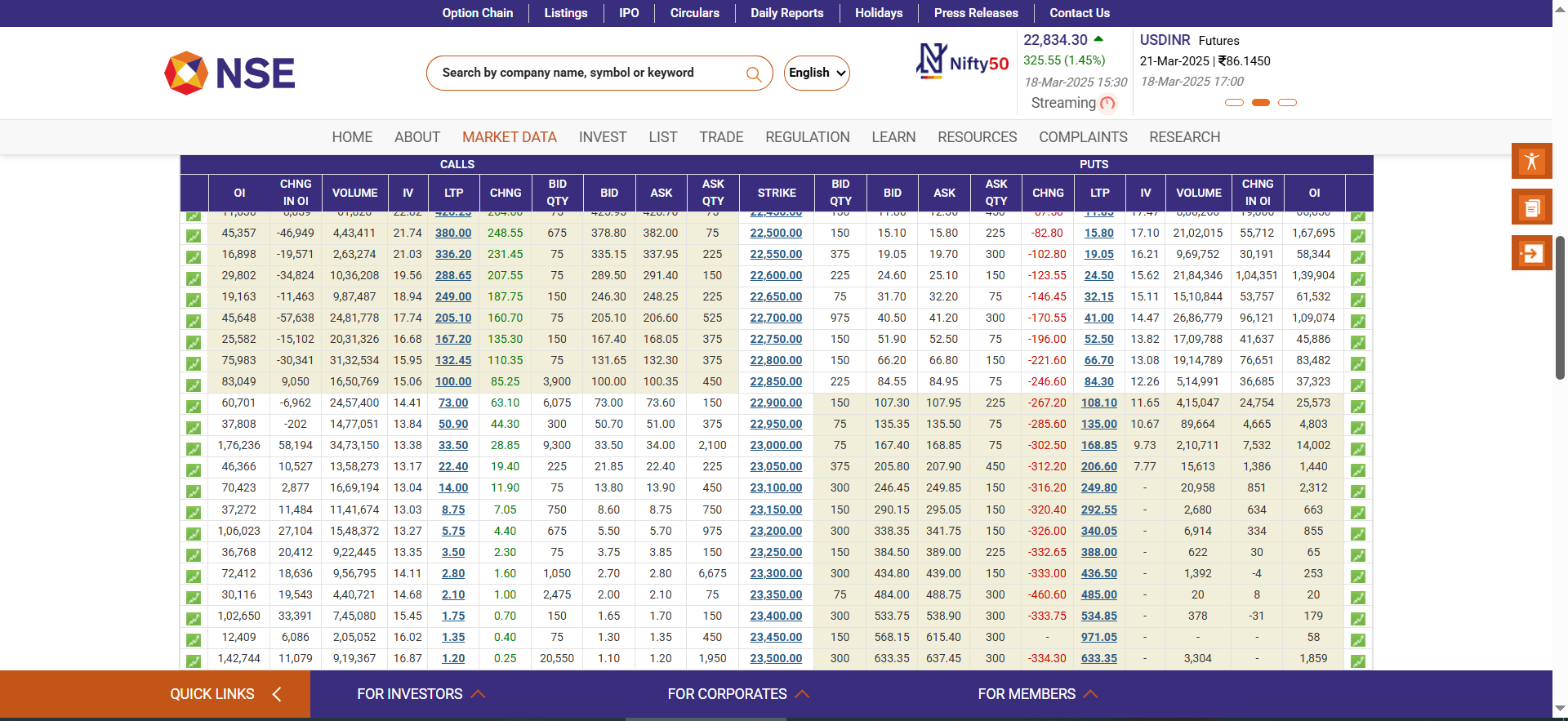

yesterday we discussed the option chain and we analyzed that 22,500 had significant call and put writing activity. Based on this, 22,600 was expected to be a crucial level, but the market made an unexpected move today, leading to short covering among put writers. Currently, 23,000 has the highest call writing activity, with 1,76,236 contracts open. On the support side, 22,880 holds 83,000 put contracts, while 22,700 also remains crucial with over 1,09,074 put contracts. The key spread to watch for tomorrow’s trade setup is between 23,000 and 22,700.

also check ; Trade setup for tomorrow; nifty prediction- 22600, global market analysis, domestic market analysis

Domestic Market Analysis

For the fifth consecutive day, the USD has weakened against the INR, which is positive for Nifty 50. The 88 level has acted as strong resistance for USD/INR, and the current closing near 86.74 supports positive sentiment in Indian equities.

Another positive factor is India’s strengthening trade relations with the U.S. Despite the ongoing tariff war weakening the U.S. economy, India has managed to resolve several trade and immigration-related issues. If the U.S. economy continues to weaken, it could work in India’s favor by facilitating smoother trade negotiations. Additionally, the Trump administration may consider exceptions for Indian trade disputes, as hinted by the U.S. Secretary of Commerce. India is also analyzing potential benefits from the global tariff war.

Since Nifty has corrected nearly 15% from its all-time high, it appears that the trade war impact has already been factored into the market. Given the prolonged consolidation phase, it remains to be seen how Indian exporters and companies will respond to the evolving trade dynamics.

Nifty 50 Prediction- technical analysis

Nifty displayed spectacular movement today, breaking yesterday’s resistance, which has now turned into support. Currently, Nifty has strong support at 22,678, while 23,000 is a near-term resistance level. The 23,000 level is also crucial from a technical standpoint, as it aligns with the moving average on the daily timeframe.

As discussed in the options analysis, several contracts are positioned around key levels, making it important to observe market reactions. In the long term, Nifty remains in a bullish pattern. However, unless it breaks above 23,800, the long-term trend cannot be confirmed as bullish. The last significant high in Nifty’s lower-high, lower-low pattern was around 23,800, making this level crucial for further confirmation of the trend.

Conclusion

Considering today’s Nifty movement and the upcoming Fed policy announcement, along with geopolitical factors like the Russia-Ukraine war, Nifty appears to be in a favorable phase. Another significant factor is the weakening U.S. economy due to the tariff war, which could impact global trade relations. It will be interesting to see how the Trump administration addresses trade agreements and their impact on India.

Additionally, Indian Prime Minister Narendra Modi has recently joined a key social media platform, strengthening direct communication with global leaders, including U.S. President Donald Trump. This could play a role in shaping future trade discussions. Ultimately, market reactions to these factors will be crucial in the coming sessions.

1 thought on “Trade setup for tomorrow; Russia -Ukraine ceasefire, Nifty prediction, FII net buyer”