Given the uncertain situation, the market is in an active mode but remains indecisive about taking any position. In the last trading session, the market moved sideways throughout the day and closed with only an 11-point gain in the Nifty. This shows that the market is still undecided.

Stock news analysis

Trump-Putin Summit

Recently, Trump and Putin concluded a summit focused on negotiations and discussions about a possible ceasefire in Ukraine, as the war has now continued for more than 3.5 years in key regions. Several serious issues were addressed during the talks. However, no final conclusion has been reached yet, as much depends on how European media and President Zelensky respond, since ultimately, he is the one who must sign any agreement.

Meanwhile, Trump posted on his social media platform Truth Social that the meeting with Putin was “very, very progressive.” He also mentioned that certain negotiation tactics, including pressure on India, played a key role in bringing Putin to the negotiation table.

Everything now depends on Zelensky, who is set to meet Trump in Washington, D.C. Reports also suggest that the European Union will participate in the talks. This could shape how the negotiations move forward and what sense or direction they ultimately take.

Here we have an analysis that if any positive outcome emerges from the negotiations between the U.S. and Ukrainian President Zelensky, it could have a strong positive effect. If that happens, there is a possibility that the September 27th address, which marks the deadline for the 25% additional tariffs on India, will play a key role. Since the deadline is approaching soon, any positive development could drive a very strong market reaction, with markets likely to take positive steps. Moreover, this would also accelerate negotiations between India and the U.S.

India’s Upcoming GST Reforms

Reports suggest that one of the major GST reform bills is expected to be introduced before Diwali, bringing significant changes to India’s taxation system. GST was first implemented in 2016, and after more than nine years, the government is now considering major updates.

According to the Prime Minister, tariffs on several goods and services are likely to be reduced, with possible adjustments to the 5% and 18% GST slabs. This move is also expected to support sectors that generate employment, earning positive appreciation from industry experts.

However, such reforms could initially have a negative impact on market sentiment in India. At the same time, they may also strengthen India’s position as a key market for global trade. The U.S., under Trump’s administration, could view this as an opportunity for American businesses to expand further into India. Additionally, these reforms might support progress toward a broader free trade agreement with the European Union, making them even more significant.

U.S. Trade Negotiations Delegation to India Postponed

The visit of the U.S. trade negotiations team has been postponed. This postponement comes at a time when the secondary tariff, set to take effect after August 27th, is also expected to impact trade. As a result, the Indian stock market may face negative sentiment, particularly affecting businesses with significant exports to the U.S.

Earlier, a reporter asked Trump about trade negotiations with India and, in response, he stated that as long as issues regarding Russian crude oil remain unresolved, there will be no talks with India. This suggests that the outcome of Monday’s discussions in Washington, D.C.—involving Zelensky and European Union leaders on a potential ceasefire—could indirectly influence U.S.-India trade negotiations as well. These are key developments, and more clarity is expected after Monday’s events.

S&P Raises India’s Rating

In a major boost to India’s economy, S&P has upgraded India’s credit rating to BBB. For context, the U.S. holds a rating of AA+, China has an A+, and Germany enjoys the top AAA rating. With this upgrade, India now stands at BBB, placing it as the world’s fourth-ranked economy in terms of credit grade.

This marks a very positive step for India’s economic outlook. The upgrade is expected to attract stronger foreign institutional investment (FII) inflows, provide greater certainty for investors, and significantly impact India’s future growth trajectory.

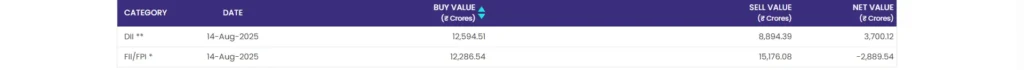

FII and DII Data Analysis

FIIs continue to show strong selling momentum in the Indian market, with no signs of reversal yet. On Thursday’s trading session alone, FIIs sold shares worth more than ₹2,889 crore. In contrast, DIIs stepped in as buyers, purchasing nearly ₹3,700 crore worth of equities.

So far in August, FIIs have sold over ₹24,000 crore — one of the fourth-highest monthly selling figures on record. This heavy selling has prevented the market from moving to higher levels. On the other hand, DIIs have maintained consistent buying support, largely driven by monthly SIP inflows. In August alone, DIIs have bought more than ₹55,000 crore, providing crucial support to the market despite persistent FII outflows.

Nifty Technical Analysis

The previous resistance at 24,700 is still active and now appears to be acting as a strong short-term resistance. Currently, Nifty is trading around 24,630 (spot level), and it is likely to test this zone in the near future.

Additionally, PM Modi’s announcement on GST reforms is expected to influence tomorrow’s trade setup, which could trigger a market reaction. On the downside, the 24,400 level is emerging as a strong support zone in the near term, reinforced by consistent DII buying and optimism around reforms.

Conclusion

The market currently remains in an undecided mood, but some key factors are expected to shape tomorrow’s direction. Two major events will play a decisive role: first, the GST reforms and PM Modi’s announcements; and second, the Alaska meeting of the Trump-Putin summit.

The success of Trump’s negotiations with Putin will also depend on how Monday’s meeting with Zelensky and European Union leaders unfolds. These developments will have a direct impact on global sentiment, and if outcomes are favorable, the Indian equity market could see a major boost. This would also raise hopes for tariff relief and strengthen prospects for future trade negotiations.