The market has shown strong bullishness following multiple surprises from the RBI, as they implemented a rate cut of nearly 50% and also unexpectedly reduced the CRR. This caught most analysts off guard and gave the market strong upward momentum, with the index closing above the 25,000 level, gaining 252 points.

The market started off moving sideways and continued in that range during the early part of the trading session. However, once the RBI meeting began, the market started moving and reacted strongly to the 50-basis point rate cut. Many analysts had anticipated this move due to controlled inflows, expecting the RBI to make such a cut. But the real surprise came when the RBI also announced a CRR cut, which triggered a strong rally in the Nifty 50.

Global Market Analysis

Trump Confirms Talks with China

U.S. President Donald Trump has confirmed negotiations with Chinese President Xi Jinping, marking a significant step forward in resolving the ongoing trade dispute between the world’s two largest economies. This is the first-time talks are being formally scheduled, indicating real progress and positive developments in trade relations.

These discussions are expected to facilitate meaningful negotiations between both countries. The key focus will be on how officials conduct the talks and what outcomes emerge from them.

The results of these high-level discussions between the global leaders are likely to have a substantial impact on market sentiment, particularly influencing Wall Street, the NASDAQ, and broader global markets.

US trade deficit narrow

The U.S. trade deficit narrowed in April, showing strong improvement as imports of goods and services declined by more than 16%, while exports increased by nearly 3%. This shift reflects the impact of global tariffs, particularly the 10% tariffs imposed by the U.S. on many countries. Notably, most of these countries have not responded with countermeasures, which has contributed to the favourable trade data.

It clearly shows that the trade war the U.S. is engaged in with other countries is having a significant impact. This will certainly push policymakers to give serious consideration to the ongoing trade negotiations. Additionally, companies are likely to rush to strike deals with the U.S., making this a meaningful development for the U.S. economy.

Elon Musk and Trump Clash: A Tense and Uncertain Situation

Things have taken an uncertain turn recently, as tensions rise between the world’s richest person, Elon Musk, and former U.S. President Donald Trump. Both parties have exchanged allegations against each other, signalling a clear disengagement.

This development holds importance from an Indian perspective, as Tesla is expected to set up a manufacturing facility in India, and Starlink is rapidly expanding its global presence. The strained relationship between Musk and Trump could potentially impact these plans.

While there is hope for a Tesla manufacturing plant in India in the near future, nothing is confirmed yet. These developments are worth closely watching.

Domestic Market Analysis

COVID-19 Cases on the Rise

COVID-19 cases have been increasing recently in India, with over 6,000 active cases reported and six deaths recorded in the past 24 hours. This situation is beginning to draw attention, although no official advisory has been issued by the central government so far.

As a result, the market is not expected to react to the rise in COVID cases at this point. It’s also important to note that the current wave has shown a low hospitalization rate, which has been a key factor in maintaining stability.

However, if there are any changes in the central advisory or a noticeable rise in hospitalization rates, the market could potentially be impacted.

CRR and Repo Rate Cut: unexpected move by RBI

In the recent monetary policy announcement, a 0.50 basis point repo rate cut was declared, along with a surprising 100 basis point cut in the CRR. This is a significant move, as it is expected to greatly benefit the banking sector. The CRR cut will provide banks with additional liquidity, while the repo rate cut will lower borrowing costs for consumers seeking loans.

Together, these measures are likely to attract considerable attention and are expected to positively influence near-term economic growth in the upcoming quarters.

The CRR cut was unexpected by analysts and has provided a strong boost to today’s trade setup, significantly contributing to the rise in the NIP250 index. This move is set to inject nearly ₹2.6 lakh crore of additional liquidity into the economy, giving banks more funds to lend.

This influx of liquidity is both impactful and meaningful for the financial sector, and as a result, the Bank Nifty surged by over 800 points today.

FII and DII Data Analysis

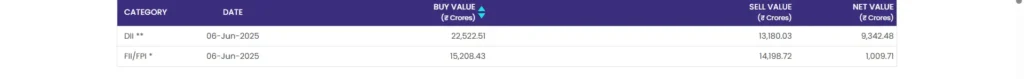

FII and DI activity is contributing to a sideways movement in the Nifty 50. Despite a major development in the market, FIIs bought shares worth over ₹1,000 crore, while DIIs purchased nearly ₹9342 crore. Both sides have made notable contributions.

Looking closely at the data, DIIs have been consistently buying in the Indian equity market, while FIIs have shown relatively lower and more sideways participation in comparison.

Nifty 50 Technical Analysis Outlook

The market has been in a consolidation phase over the past month, with a key resistance zone between 25,000 and 25,100. This level has acted as a strong barrier during this period.

In the coming trading sessions, we may see the price approaching this resistance zone again, as the index has closed above 25,000 and near the day’s high, forming a strong bullish candlestick pattern. This indicates potential continuation of the upward momentum.

So, in the short term, we are going to see the 25,200 level as a kind of resistance. It is probably a weak resistance, but still a resistance. In terms of support, we are going to see support near the 24,700 level, which is a very good support for the near term, as the moving average of 1 is there.

Conclusion

After analysing all the data, we see that the FIIs and DIIs are making some movement in the Indian equity market. At the same time, if we look at the recent announcements by the Monetary Policy Committee — a 50 basis point cut and a 100-basis point cut in the CRR — these actions could create strong short-term momentum and attract the attention of FII investors. Consequently, we are likely to see good short-term growth, led by the banking sector.

We mentioned in previous trade setups several times that we need new reasons to make new highs. Now, a new reason has arrived. This is a good sign for the short term, and we may pay attention because of it. The market may show strong and sustainable gains.

1 thought on “Trade setup for 09 June; Nifty eyes on 25200 level, US trade deficit narrow and Rise in covid cases”