In the Nifty analysis, we discussed a 02 may trade setup, noting that Nifty had formed a kind of hammer pattern with a long wick. This indicated that the market might either move downward or face resistance in moving higher.

In yesterday’s trade setup, we also mentioned that although the market had risen, the hammer pattern could act as a hurdle, making it difficult to break that level in the short term. As per this two-way analysis, the market moved accordingly and declined by around 80 points.

In yesterday’s conclusion section, we also discussed that Nifty is likely to find support at the 24,350 level, which was previously a resistance and has now turned into support. This level has become significant because, after five consecutive trading sessions, Nifty closed above it yesterday, and today it is acting as a support. Tomorrow, this level will be tested again, and we are observing strength at this level, as it seems to be preventing Nifty from falling further.

Global Market Analysis

Fed meeting

The Fed meeting, led by Jerome Powell, is scheduled for tomorrow, where key policy decisions will be made by all Federal Reserve members. This meeting is particularly crucial, as it’s the first one taking place after Trump announced tariffs affecting global trade.

The impact of these tariffs—especially on inflation and economic growth—will be a key focus of discussion. Another important aspect will be the Fed’s stance on potential rate cuts, and any decisions made could influence upcoming trade setups for Wall Street traders.

Trump’s Pressure on Jerome Powell

Former President Donald Trump has previously criticized Jerome Powell for not cutting interest rates, which led to public disagreements between the two prominent figures in U.S. leadership. At one point, reports suggested that Trump was considering removing Powell from his position as Fed Chair. However, those claims were later denied by Trump himself.

Despite this, the pressure for a rate cut from Trump has been evident. Historically, Powell has maintained his independence and has not altered policy decisions based on political pressure. As this is the first rate cut decision since Trump reignited pressure and debate over Powell’s leadership, all eyes will be on how the Fed responds.

Domestic market analysis

India–UK Free Trade Agreement

India and the United Kingdom have signed a landmark bilateral free trade agreement, marking a new era in trade relations between the two countries. This deal is expected to be mutually beneficial, although it may also bring certain challenges. As part of the agreement, India has agreed to lower import tariffs on goods coming from the UK, while the UK has done the same for Indian exports.

This free trade agreement not only strengthens economic ties between India and Britain but also paves the way for further trade engagements with the European Union. It represents a significant milestone in global trade diplomacy.

IT Sector in Focus

Recently, the IT sector has seen a significant pullback from its highs. With the tariff war set to take effect, concerns have risen about the U.S. economy. This is particularly important for companies like Infosys and TCS, which heavily rely on U.S. business—around 60% of their revenue comes from the U.S. Therefore, the state of the U.S. economy and global trade directly impacts the Indian IT sector. Tomorrow’s trade meeting will be crucial, as its outcome could influence market sentiment and prompt a response from the IT sector based on any major developments.

GIFT Nifty on the Rise

GIFT Nifty has risen nearly 100 points ahead of the May 7th trade session, marking a significant move. This surge appears to be driven by the positive sentiment surrounding the recently signed bilateral trade agreement between India and the UK.

The market is responding not just to the deal itself, but to the broader potential it represents—opening avenues for future trade agreements with the European Union. This is particularly important, as India has historically benefited from strengthening business ties with Western economies.

FII&DII Activity

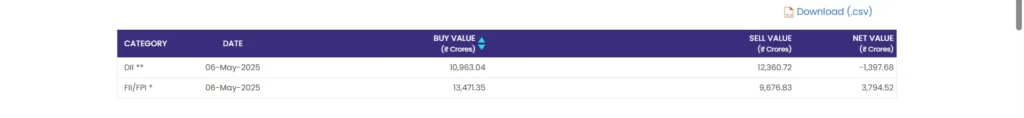

FIIs are taking impressive steps toward building long positions and have emerged as net buyers in the Indian equity market. In the May 6th trade session, FIIs bought shares worth approximately ₹3,794 crore while selling ₹1,397 crore—indicating strong buying interest.

This consistent buying trend shows that FIIs are becoming active supporters of the Nifty 50 and the broader market. Notably, this marks the third consecutive day in May that FIIs have been net buyers. This is a positive signal for Indian equities and adds strength to the support level around 24,350, which we mentioned earlier. FII confidence could play a key role in maintaining this crucial support zone.

NIFTY 50 trade setup for tomorrow

The technical analysis approach we’ve been applying to the Nifty-50 trade setup is delivering solid results, as previous forecasts have played out accurately. Looking ahead, the 24,600 level stands out as a key resistance based on technical indicators.

Beyond that, a strong resistance zone begins around the 24,800 level. On the support side, the 24,350 level continues to act as a solid near-term support, followed by additional support at the 24,238 level. These two resistance levels and two support levels provide a clear technical framework for the upcoming sessions.

Combining technical analysis with current data points, we observe a supportive setup for the 7th May trade session. Firstly, FIIs have been consistent net buyers, indicating strong institutional confidence. Secondly, the recently signed UK–India bilateral trade deal has boosted short-term market sentiment. Thirdly, the 24,350 level continues to act as a key technical support. Taking all these factors into account, the 24,350 level is likely to hold as a strong support for the upcoming trade session.

Conclusion

Banking stocks are providing muted support to Nifty, while the defence sector is showing a strong rise amid ongoing tensions between India and Pakistan. This geopolitical backdrop, along with FII activity and broader market sentiment, is likely to influence tomorrow’s trade setup.

With these combined factors, there’s a possibility that Nifty could attempt to reach the 24,600 level in the upcoming session. Whether it touches that level or not, tomorrow’s movement will be key in shaping the short-term market direction. Let’s see how the situation unfolds.