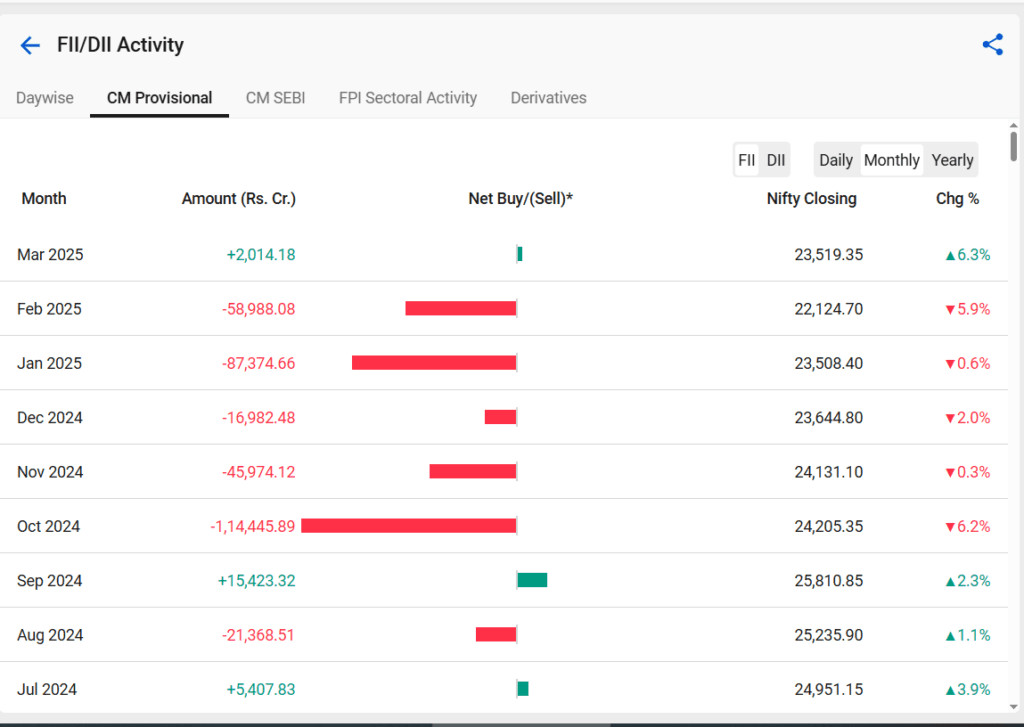

In March, the market showed a robust upward movement, led by positive FII inflows, with a net gain of nearly ₹2,014 crores. The market closed about 6.30% higher from its low, which was formed after reaching a high in September. Following that high, the market declined by approximately 16%. However, March was the first month in which the market recovered those losses, closing the month in the green.

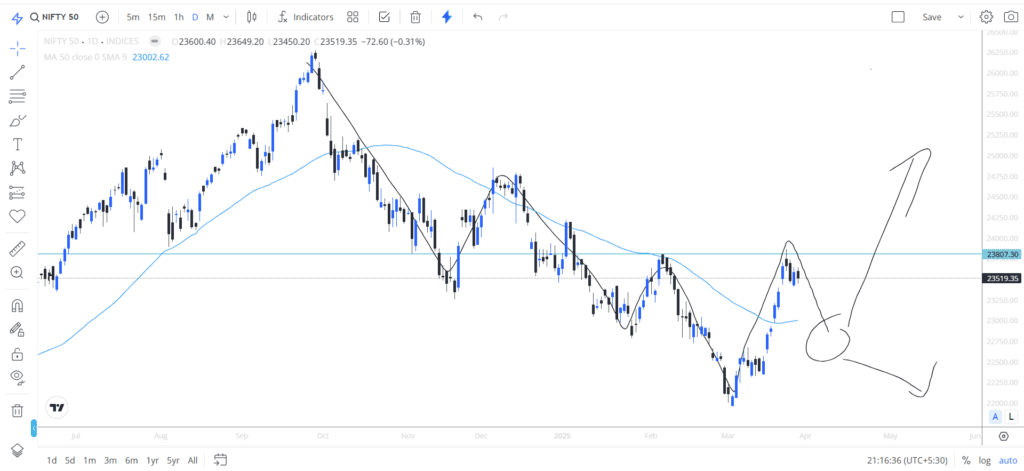

The market opened flat and then saw a slight bearish movement, dropping nearly 100 points. However, it later recovered all those losses and briefly moved into positive territory. Despite this, it couldn’t sustain the gains, as our analysis indicated strong resistance at higher levels due to bullish pressure. Following this, the market experienced a continuous decline from the 23,650 level to around 23,450. In the second half, it staged a minor bullish recovery but ultimately closed nearly 70 points lower.

Global market analysis

Goldman Sachs has indicated a 35% probability of a US recession, driven by ongoing tariff wars, which is contributing to bearish sentiment in the market.

Additionally, if Russia does not comply with the Ceasefire talks, Trump has stated that secondary tariffs will be imposed on Russia. This could have a significant impact, particularly on countries purchasing Russian oil, potentially disrupting trade. Such measures would affect the Russian economy and influence the ongoing CSPY negotiations. How this situation unfolds remains to be seen.

A major development has occurred between Iran and the US, as Trump recently sent a letter proposing negotiations on the nuclear deal, which was originally implemented during the Obama administration. Trump now seeks to renegotiate with new terms, but Iran has rejected the proposal, considering it a humiliation for the US.

In response, Trump has stated that the US will take military action against Iran, warning of an unprecedented level of bombing. This has escalated tensions significantly, as Trump’s unpredictable policies make it difficult to anticipate his next moves. This situation remains critical and could have far-reaching consequences.

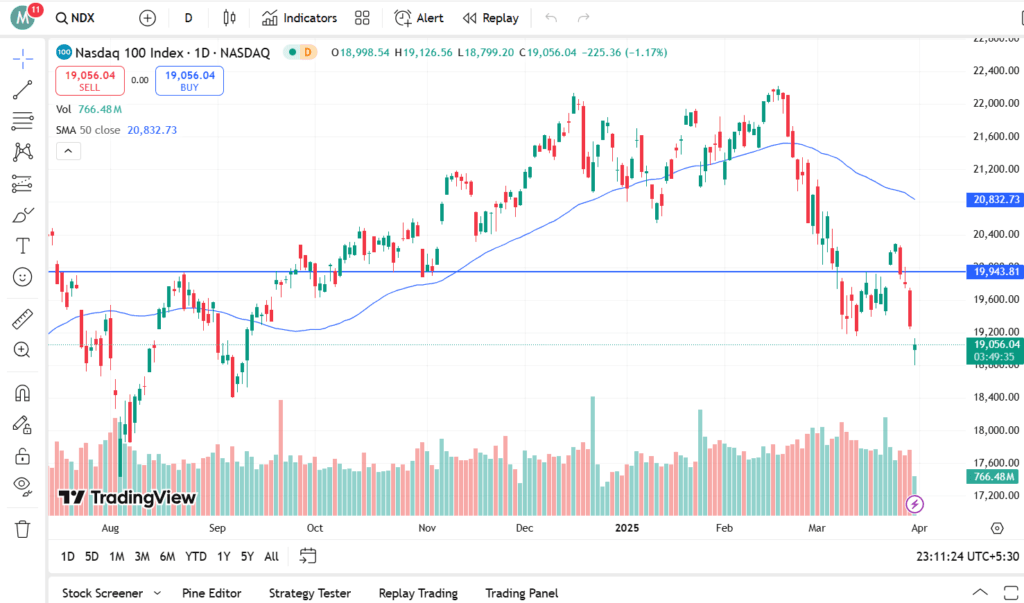

The Nasdaq has experienced a sharp decline, dropping nearly 7% over the last three trading sessions, creating significant concerns for stocks and investors. This downturn is largely driven by the impact of reciprocal tariffs, which are affecting key industries and market operators.

As time progresses, Trump remains firm on his policies, adding to market uncertainty. The US market is already in a concerning zone, with investors closely watching how these developments unfold and what impact they will have on the broader economy.

Domestic market analysis for trade setup for 01 April

The upcoming trade setup for the US is crucial due to significant developments involving Russia and Iran. Reports suggest that Trump is considering secondary tariffs on countries buying Russian oil if Russia disrupts the ceasefire. This could impact major buyers like India, which heavily relies on Russian oil imports.

While the probability of such tariffs being imposed remains low, the uncertainty surrounding Trump’s administration makes it difficult to predict their next moves. If implemented, these measures could create a complex situation for both Russia and India, potentially affecting global trade dynamics.

The Indian equity market surged nearly 6.3% in March, supported by strong buying from FIIs. Looking ahead, the focus will shift to the upcoming month, as several data points suggest that FIIs are rebalancing their portfolios. The next one to two weeks will be crucial in determining how the market sustains its gains and how policies will impact Indian equities. Additionally, the reaction of FIIs will play a significant role. The upcoming trade setup over the next two months will be critical to watch, as it will shape the market’s direction.

FII & DII analysis and option chain analysis

FII & DII analysis

After five consecutive months of negative performance, March saw a net positive for the market, driven by positive FII buying, which helped boost the market from February’s gains. Now, all eyes are on April, as this month will be crucial for market movements, with significant events such as the potential implementation of tariffs set for early April. The US administration’s actions in this regard will play a key role, and the market’s reaction to these developments will be important to observe.

Moreover, FII buying has provided significant relief to Indian equities and retail investors. On April 28th, in Friday’s trade setup, FIIs sold approximately ₹4352 crores, while DIIs bought nearly ₹7646 crores, indicating a rebalancing of positions. As we move into the next week, the data from FII and DII will be closely watched to assess their impact on market direction.

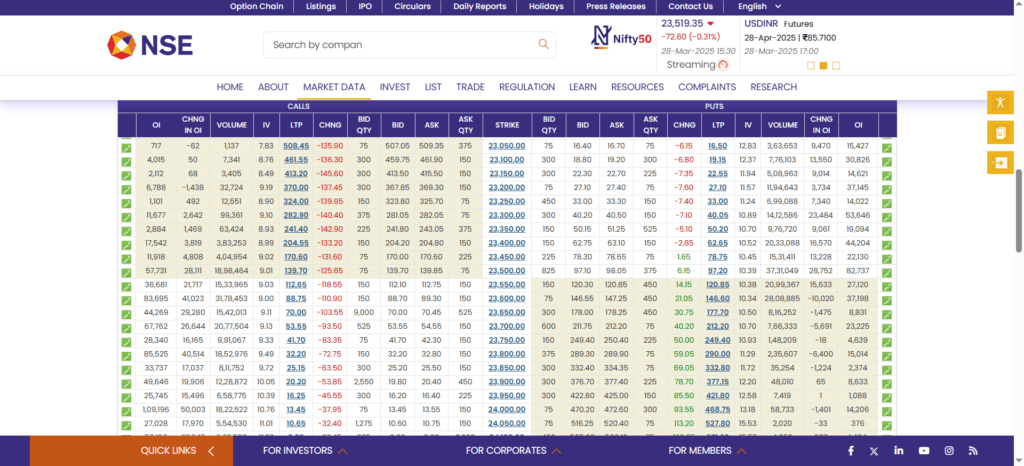

Option chain analysis

As we enter the month of April, the option data and volume are becoming more significant, reflecting in the option chain. Looking at the near-term levels, we see strong resistance from call writers at the 23,600 level, with approximately 83,695 contracts. At the same time, there is support at 23,500, with around 82,737 contracts. Additionally, further support is seen at 23,300, with about 53,646 contracts.

These levels are important, but as we approach expiry, the data will become more relevant and the impact of upcoming events, such as tariff changes, may lead to increased volatility. Both upside and downside risks could come into play, depending on how these events unfold, making this an uncertain and crucial time for market movement.

Nifty 50 prediction

Looking at the previous week’s trade setup in a cumulative way, we can see that the market experienced choppy movement. The 23,800 level, which we’ve discussed multiple times in earlier analyses, proved to be a key level, acting as either a trend-changing or trend-following point. As expected, the market formed a doji followed by an evening star candlestick pattern at this level, making it a strong resistance zone.

There are three main factors to consider:

The 23,800-level acting as resistance.

The formation of the evening star candlestick pattern.

The impending trade war developments that are set to be implemented in the coming week.

These factors combined make the upcoming week crucial. Adding the uncertainty around FII data, it remains unclear how FIIs will react. If the buying trend continues, it could influence market direction, but if it shifts, it will add further volatility. How this plays out will be key to determining the next move in the market.

Conclusion

We are currently at a stage where observation and understanding of the market are key. It is difficult to predict the market’s next move as we’ve seen a strong bounce in India, with a rise of over 6% in March, while the global market, particularly the US, has faced a sharp decline of nearly 7% in the last three trading sessions. The situation remains fluid, and how things will play out depends on various factors, including the developments surrounding the trade war and tariffs.

At this point, it is essential to monitor the situation closely rather than making definitive conclusions about the Nifty50. We should observe how the data unfolds in relation to the trade tensions, as these will significantly impact market movements in the coming weeks.