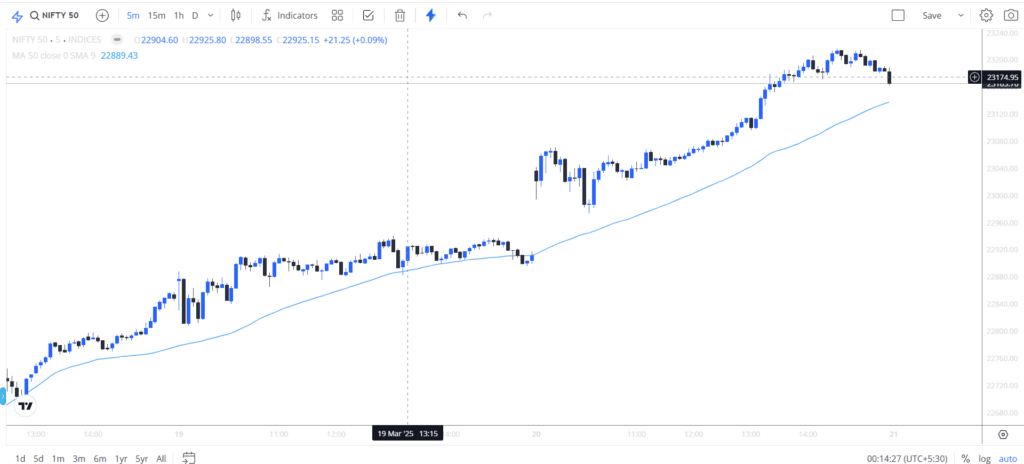

The market continued its bullish momentum, forming a continuation pattern that led to further gains also easing the Trade setup for bulls. The resistance levels that once acted as obstacles have now turned into strong support. The market has crossed a key level with good volume and strong candle formations.

NIFTY surged approximately 300 points in a single day and closed above the crucial 23,000 level. It ended the session at 23,190, marking an impressive rally.

The market showed strength right from the opening as it gapped up and did not even dip below the 5-minute 50-day moving average, which previously acted as a resistance. However, today, the market displayed strong bullish sentiment and did not even test this moving average throughout the day, indicating aggressive control by the bulls.

After a strong opening, NIFTY briefly tested lower levels but faced minimal resistance. Within just 2-3 candles, it bounced back and dominated the day.

Global Market Analysis

FED on the US Economy

Yesterday, the Federal Reserve held a meeting regarding monetary policy and its impact on the economy. The committee, led by Fed Chair Jerome Powell, decided to keep interest rates unchanged due to concerns about the US economy, particularly the ongoing tariff war.

Analysts had expected the Fed to express concerns about the economic impact of tariffs, and as anticipated, the economy is showing signs of strain from the trade tensions between major global economies.

The committee expects US economic growth to slow due to tariffs, and inflation is projected to rise as a result. These concerns have created uncertainty. However, the Nasdaq reacted positively, closing 1.5% higher for the day. At one point, it was up nearly 2% before pulling back later.

Markets have already factored in potential obstacles such as inflation and economic slowdown due to tariffs. Despite a 13% decline from its highs, investors expected Powell to issue cautionary remarks rather than an extremely negative outlook. The Fed is considering two potential rate cuts in the coming months, in line with earlier projections.

Sustaining this momentum will depend on upcoming economic data, including inflation and unemployment figures. If these numbers exceed expectations, the Fed’s decision on rate cuts could be altered significantly.

In contrast, former US President Donald Trump has suggested pushing the Fed for interest rate cuts to support economic growth. The Trump administration sees potential economic hurdles and may influence central bank policy.

Russia-Ukraine War Ceasefire

After discussions between Trump and Putin, a ceasefire deal appears to be in progress, with both sides agreeing to end the conflict under certain conditions. Ukrainian President Zelensky has confirmed ongoing talks with Trump regarding further negotiations.

European countries, however, have raised concerns about continuing arms shipments to Ukraine. Germany has publicly stated that it does not support halting military aid to Ukraine.

Middle East Conflict

The Middle East remains a focal point of global tensions. Israel has resumed attacks on Hamas following a failed ceasefire agreement. Hamas has yet to release 59 hostages, leading to intensified Israeli airstrikes on Gaza, which have reportedly resulted in 400 civilian casualties.

Israel has announced plans to continue military operations until the hostages are released. In response, the US launched significant airstrikes on Houthi rebels, warning them of severe retaliation if further conflict arises. Reports suggest that Iran is indirectly supporting these groups, though no direct statements have been made.

FII& DII activity & Option chain analysis

FII& DII activity

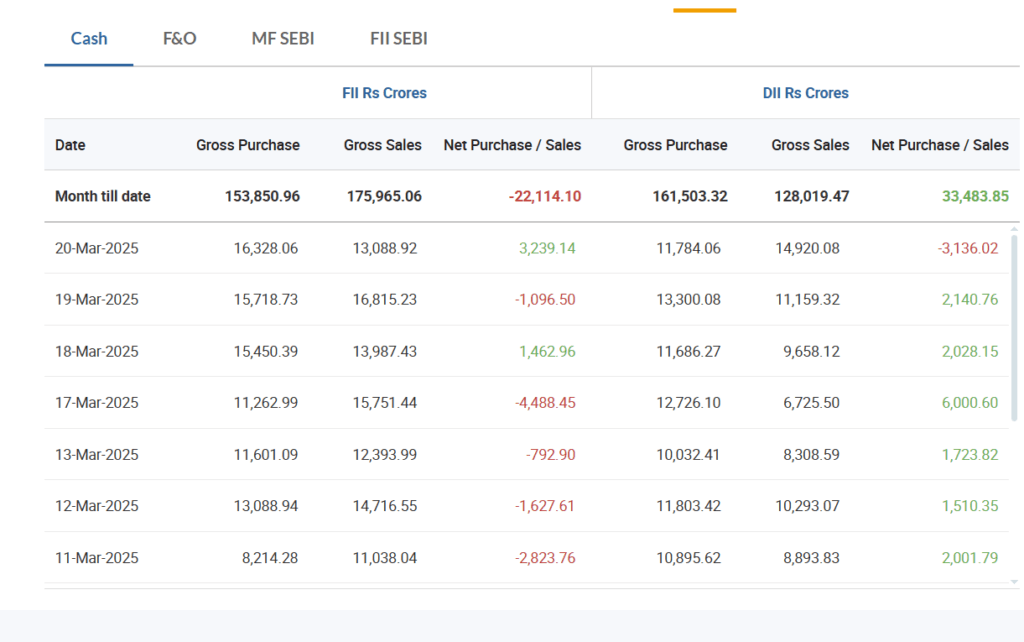

The market maintained its bullish momentum, with a nearly 300-point surge. Bulls are strengthening their positions, and today, FIIs purchased equities worth over ₹3,200 crores, further boosting market sentiment.

However, concerns remain about the sustainability of FII investments, as they have been net sellers for most of the week. The last trading day’s data will be crucial in determining whether FIIs continue their buying streak. If they close the week as net buyers, it could boost confidence among retail investors.

Also read ; Trade setup for tomorrow; nifty prediction, fed meeting outcome, FII net seller

As previously discussed, geopolitical concerns, particularly in China, are prompting FIIs to consider investing in the Indian stock market. If this trend continues, it could support sustained foreign investment.

Option Chain Analysis for Trade Setup

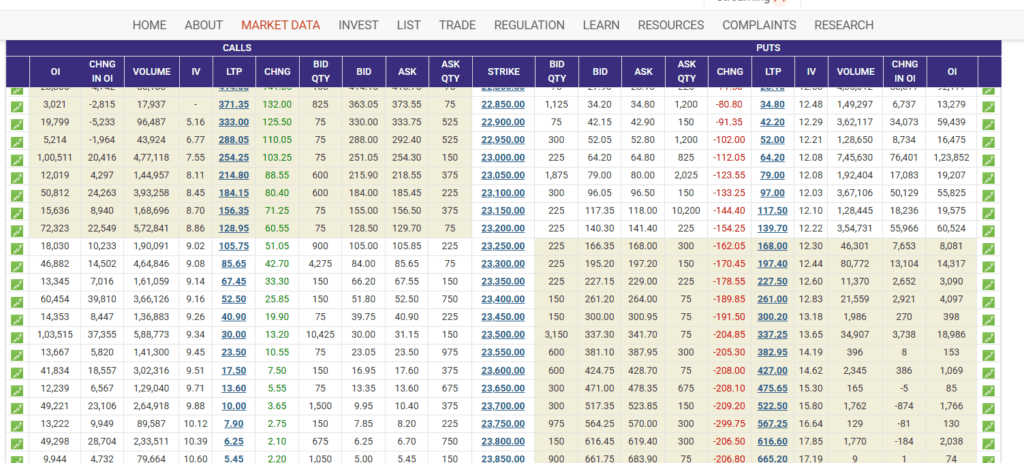

NIFTY expired above the 23,000 level, leading to aggressive short-covering by call writers. The options market was dominated by put writers today.

- Key Resistance Levels:

- 23,200 is a strong resistance level with significant open interest.

- 23,500 has over 1 million contracts, making it another crucial resistance zone.

- Key Support Levels:

- 23,000 has strong support with 123,852 contracts from put writers.

- 22,800 is another key support zone with 92,000 contracts.

Domestic Market Analysis for Trade setup

With April approaching, the US-India trade deal remains unresolved. Recently, Trump stated that the US will impose reciprocal tariffs on India, indicating that no relief measures are in place yet. Negotiations are still ongoing.

The banking sector continues to lead the rally, while the IT sector also showed strength today. Rate cuts are being considered, as inflation data suggests a possible decline, which would benefit banking stocks. Given that banking stocks have the highest weightage in NIFTY 50, this sector’s performance is crucial for market stability.

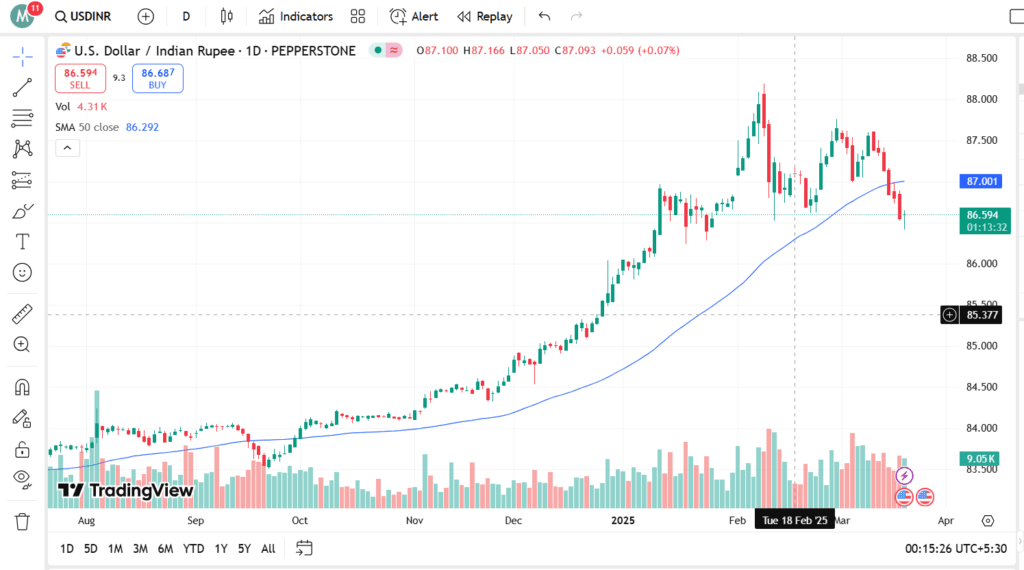

Additionally, the INR has been strengthening against the USD for seven consecutive days. Today, the USD/INR exchange rate stood at 86.26, marking a significant improvement from previous levels. This stability in the currency market is a positive sign for equities, especially given prior concerns about the impact of trade tariffs.

The NIFTY 50 has now gained for four consecutive days, a remarkable performance for the week. However, midcap and small-cap stocks have not reacted as strongly. If the NIFTY rally sustains, confidence in midcap and small-cap stocks may increase.

NIFTY Prediction – Technical Analysis

The NIFTY 50 has shown an unexpected rally, turning previous resistance levels into strong support. However, the market remains in a consolidation phase with no major confirmations regarding trade tariffs, ceasefires, or economic growth projections.

The long-term trend remains bearish, but short-term bullish momentum has been driven by FII buying. If positive developments occur in tariffs, geopolitical stability, and Q4 earnings, further upside could be expected.

Currently, 23,800 remains a strong resistance level. If NIFTY crosses this, it could indicate a confirmed trend reversal. With April 2 approaching and no major bearish pressure, 23,800 remains a key level to watch.

For now, bulls need to remain cautious, as the long-term trend is still bearish. There is a limited upside of around 600 points before facing crucial resistance at 23,800.

Also read ; Technical analysis; Difference between technical and fundamental analysis

Conclusion for Trade setup

While the recent market movement appears strong, it is important to remain cautious. FIIs turning net buyers and the strengthening of the INR are positive factors. However, unresolved trade tariff issues remain a concern.

At this point, there is no clear confirmation regarding NIFTY 50’s future direction. If the market sustains this rally with strong data backing it, bullish momentum could continue. However, without concrete developments, there is a risk of a correction.

Investors should remain vigilant and monitor global cues closely before making any significant trading decisions.

2 thoughts on “Trade setup for 21 March; Nifty prediction 23800, global market analysis, FII net buyer today”