SBI is considered one of India’s biggest public sector banks, with nearly more than 45 crore accounts in the Indian banking system, making it the largest bank in terms of the number of accounts. It has a strong presence in both rural and urban sectors.

If we look at the numbers, SBI reported a profit of more than ₹80,000 crore in the financial year 2025, which is the highest-ever profit for the bank. Additionally, it had assets of nearly ₹7 lakh crore in the financial year 2025, also marking an all-time high for the bank.

Banks have more than 24 crore active debit card users, which is a significant factor in the growth of the digital banking business. Additionally, the bank has a strong physical presence, with 22,937 branches across 17 circles in India. The bank also recorded a 9.48% year-on-year growth in deposits. All these factors of convenience help explain why the bank’s profit and revenue are increasing so significantly.

Revenue source for SBI bank business

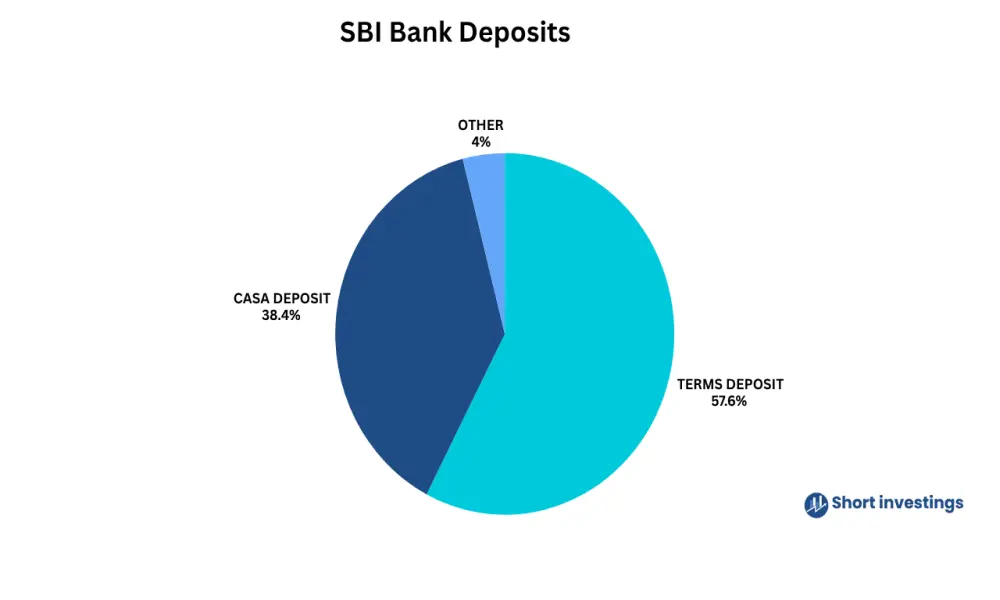

In a simple way, SBI follows a straightforward banking model. It collects deposits through CASA ratios—Current and Savings Account ratios—and utilizes those deposits to generate higher yields. These funds are then disbursed as personal loans, home loans, and other types of advances.

In return, SBI charges interest on these loans, which becomes the major source of income for the bank—known as interest income.

Now, the important thing is that the company must create highly accessible services and aim to attract more and more deposits from retail customers. This makes the growth of the CASA ratio extremely important.

Deposit & advance growth of SBI

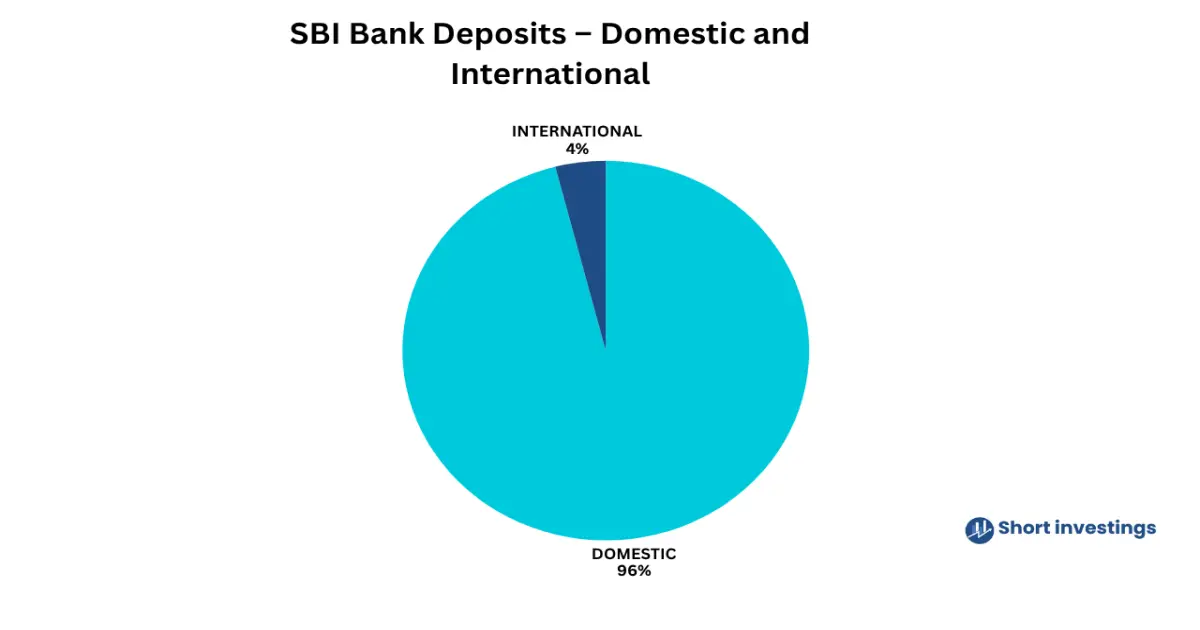

SBI’s deposits grew by approximately 9.48% in the financial year 2025, reaching ₹53.82 lakh crore. Out of this, domestic deposits grew by 9.37% to ₹51.67 lakh crore, while foreign office deposits increased by 30% to ₹2.15 lakh crore.

Term deposits also witnessed a robust growth of 11.38%, reaching ₹31.02 lakh crore, which is a very significant figure for the bank.

The combined CASA ratio grew by approximately 6.34%, reaching ₹20.65 lakh crore in the financial year 2025.

Now, advances have also shown strong growth. SBI’s total advances grew by approximately 12.03%, reaching ₹42.21 lakh crore in the financial year 2025. Within this, domestic credit increased by around 11.56% to ₹36.02 lakh crore, while the foreign offices’ loan portfolio grew by approximately 14.84% to ₹6.1 lakh crore.

Income from the interest and investment

So, banks’ main business comes from lending like the other banks, and the majority of their revenue comes from the interest they earn on advances. The interest and earned income in the financial year 2025 is 4,90,938 crores for banks. This makes it one of the highest sources of revenue. In return, banks have to pay interest to depositors against those advances or deposits. The interest expense for banks amounts to 3,00,943 crores. Additionally, banks have several operating expenses as well, which account for nearly 2,36,573 crores.

Bank also earn a significant portion of their income from other sources, which is supported by investments in SLR securities. Due to regulatory requirements like CRR (Cash Reserve Ratio) and SLR (Statutory Liquidity Ratio), banks are required to set aside a portion of their funds.

In the case of SLR, banks invest these funds in government-approved securities, and in return, they earn income—classified as “other income.” In the financial year 2025, SBI earned approximately 1,72,406 crore as other income through this route.

Global presence of SBI business

SBI is also a geopolitically active business. As the Indian economy continues to grow and show strong prospects in the upcoming forecasted years, SBI is making consistent efforts to expand its banking presence across the globe, especially outside India.

The bank is striving to establish and grow its international business footprint. Currently, SBI operates through approximately 244 overseas offices across 29 countries. Additionally, it provides YONO Digital Banking Services in 55 countries, making banking more convenient for its global customers—a truly significant achievement. Thank you.

The company also received deposits of approximately ₹2.15 lakh crore from its foreign offices in the financial year 2025, reflecting a growth of 12.30%. Additionally, advances from these foreign offices stood at around ₹6.19 lakh crore, marking a growth of 14.84%. These figures indicate that SBI’s overseas business is making steady and gradual progress.

Sustainability of the SBI Business

SBI has built a very sustainable business over the past few years, and there are several reasons behind this. One of the key factors is that SBI is a public sector bank. Because of this, government policies often align in favour of the bank.

For example, government employees are typically required to open their salary accounts with SBI, meaning their salaries and transactions automatically flow through the bank.

This consistent inflow is highly beneficial, as it helps SBI maintain a stable deposit base. Additionally, SBI offers attractive premium plans, which encourage long-term deposits. The bank then uses these deposits to issue advances and generate interest income—one of its primary sources of revenue.

SBI is receiving strong support through its deposits, as its certificates of deposit hold an A+ rating from CRISIL. Additionally, the bonds issued by the bank to raise funds are also highly rated. For instance, the Tier 1 bonds carry a AA+ (Stable) rating from CRISIL, ICRA, CARE, and India Ratings, while the Tier 2 bonds have a AAA (Stable) rating from the same agencies.

This strong credit profile allows the bank to raise funds at affordable interest rates, thanks to its financial stability and high bond ratings from major rating agencies.

SBI’s Strong Presence in Cash Dispensation and Daily Transactions

SBI is responsible for dispensing 34% of the total cash in the country, which is a highly significant figure. This clearly reflects how SBI has established a strong presence and achieved substantial success and sustainability within the Indian banking system.

Additionally, the bank handles around one crore transactions daily, along with six crore cash deposits every single day. These impressive numbers highlight SBI’s scale, operational strength, and the trust it has built among Indian customers—further reinforcing the sustainability and reliability of its business model.

SBI’s Dominance in Government Schemes and Services

SBI is dominating the market with 33 products and services offered through its Customer Service Points (CSPs). The bank also holds a leading market share globally in several government schemes—capturing around 47% in the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), 40% in the Pradhan Mantri Suraksha Bima Yojana (PMSBY), and a significant share in Direct Health Enrollment under the Ayushman Bharat initiative through API.

Banks account for a significant portion of business in the government sector. Around 62% of government-related transactions take place through SBI Bank, which shows strong sustainability as well.

Such involvement in key government schemes greatly benefits SBI’s business, reinforcing its presence and contributing to its sustained growth.