When we make an investment in the stock market or any type of security, such as debt securities, stocks, or bonds, we need to store that security in a depository. In India, there are two main depositories: NSDL and CDSL.

NSDL is considered one of the key depositories in India, holding nearly 99.99% of FII accounts and managing more than ₹4 trillion in assets under management (AUM). This gives NSDL significant importance in the Indian depository market and makes it a highly successful business in this field.

NSDL has been in operation since 1996, when it started its depository services. It has consistently worked to facilitate the sale of unlisted assets and the dematerialization of securities, making the process more convenient so that more and more securities are moved into the electronic depository system.

Currently, companies hold nearly 86.6% of the market share in terms of total custody value. At the same time, HUF (Hindu Undivided Family) accounts hold a market share of about 67.5% of the total custody value. This highlights the importance of NSDL’s presence and shows how efficiently the depository business is being managed when we analyze these significant factors.

The NSDL Business also has a strong presence in the depository of unlisted shares, accounting for nearly 73.2% of the total equity shares of unlisted companies. Additionally, it has recently crossed 4 crore total demat accounts, which is another key milestone.

How Does NSDL Make Revenue?

As the depository market expands, NSDL’s revenue is also growing, driven by the increasing participation of Gen Z, Millennials, and other market entrants in the stock market. The more demat accounts that are opened, the greater the demand for related services and associated businesses, leading to a surge in revenue.

The business model of NSDL is similar to that of CDSL, as discussed earlier. According to the standalone business update for Q1 of FY26, the majority of NSDL’s revenue comes from annual issuer charges. These charges are mandatory for any type of security listed on the stock market—whether bonds, debentures, stocks, or debt securities. Issuers must pay this annual fee to the depository, and this forms the primary revenue stream for NSDL.

In fact, about 36% of the company’s total revenue—nearly ₹70 crore—comes from these annual issuer charges alone.

The second major revenue source for the company is the settlement fee, which contributes around 7.70% of total revenue, amounting to nearly ₹14 crore. This is a profitable segment, as settlement fees provide a steady contribution to the company’s income.

The third significant revenue stream comes from transaction charges. Whenever shares are bought or sold, a transaction fee is applied. This segment accounts for nearly 30% of the company’s revenue, making it a key driver of earnings. Transaction charge income rises when trading volumes are high—particularly during bullish market phases when both investors and traders are more active. In such periods, depositories like NSDL generate strong revenue from this source.

Additionally, the company earns revenue from corporate actions (such as dividends, bonus issues, and rights issues) and from listing fees when a new company gets listed on the stock exchange. This category contributes roughly 7% of the total business.

Apart from these revenue sources, NSDL also earns about ₹13.62 crore from other income. Looking at the overall structure, the annual issuer income—one of NSDL’s major and most stable revenue streams—remains consistent without significant fluctuations.

In contrast, bullish market conditions tend to boost trading activity, which in turn increases transaction charges. A strong market also encourages more companies to participate in and enter the Indian stock market, leading to additional income from corporate actions and IPO listings. Therefore, during bullish phases, a depository like NSDL can expect to generate higher revenue from these variable sources.

Expenses of NSDL

As a depository, NSDL operates primarily in a digital environment, which brings certain essential expenses to maintain consistent revenue growth. Since most of its business is digital, there are substantial costs related to IT infrastructure, hardware maintenance, cybersecurity, and related services.

Being in the depository business also means dealing with a large number of retail investors, some of whom are new to the market. This requires spending on investor education, support services, and building strong infrastructure so that brokers and other participants can use depository-related services efficiently and conveniently.

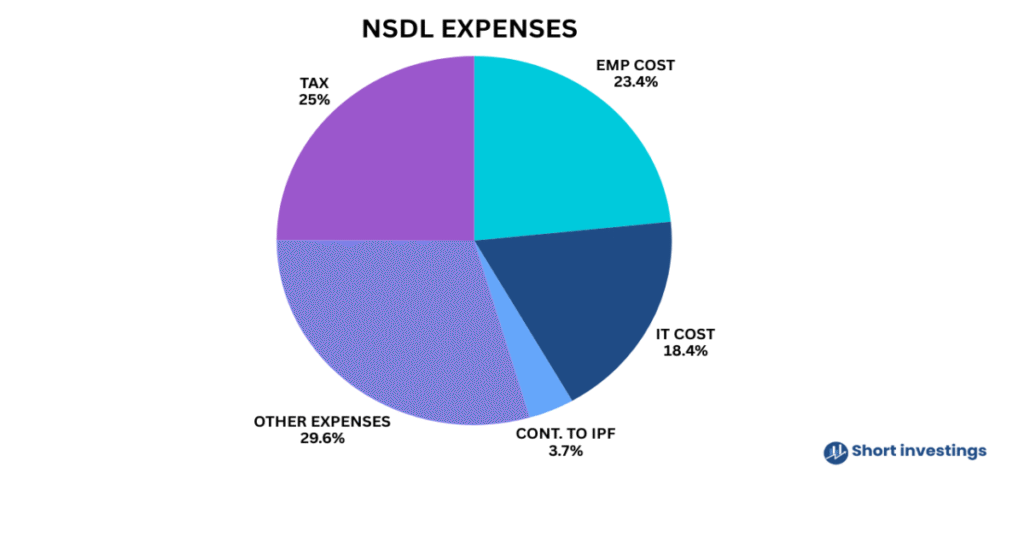

In terms of cost structure, employee expenses account for about 23.38% of total expenses, while IT services contribute around 18.37%. NSDL has already made significant investments in IT infrastructure. If these investments are leveraged effectively without further major increases in IT spending, the company’s operating margins could improve in the future.

Another expense category relates to contributions to the Investor Protection Fund (IPF) and other miscellaneous costs. In addition, taxes form a significant part of the company’s expenses. Other expenses account for nearly 30% of total costs, while tax expenses contribute about 25%.

Future Outlook for the NSDL Business

The depository business in India has a very bright future. Out of India’s population of around 145 crores, only about 20 crore demat accounts have been opened so far—and NSDL holds 4 crores of them. This indicates there is still substantial room for growth in the market.

In addition, there are several associated revenue opportunities for depositories. For example, corporate actions—such as bonus issues, rights issues, or capital increases—lead to higher issuer income. As companies grow their capital base, the fees charged by depositories for these services also rise.

Furthermore, with processes becoming more seamless and efficient, raising capital in India is becoming easier, which in turn increases issuer income. All these factors combined suggest that the depository business in India, and NSDL in particular, is well-positioned for strong future growth.

NSDL has only one direct peer in the market—CDSL. In certain segments, NSDL holds an undisputed position. For example, all Foreign Institutional Investors (FIIs) in India are registered exclusively with NSDL. Currently, more than 11,000 FIIs have their accounts with the company.

This exclusive dominance in specific areas ensures a steady and strong revenue base. As the market grows, more investments flow in, and higher returns attract additional participants. This, in turn, benefits NSDL’s business, as the depository sector naturally expands with the increasing number of market participants.

NSDL Achieves Historic Milestones in Settlement Speed and Custody Value

India’s capital markets have reached a new milestone with NSDL leading the way in both settlement speed and asset custody growth. Over the years, trade settlement in India has become faster and more efficient. Starting with T+3 settlement in April 2002, the cycle was reduced to T+2 in April 2003, then to T+1 in January 2023. In March 2024, India became the first country in the world to roll out T+0 settlement (beta phase), enabling same-day trade settlements — a major leap towards real-time market operations.

Alongside this, NSDL’s custody value — the total worth of securities held in its depository — has grown at an unprecedented pace. It reached $1 trillion (₹40 lakh crore) in 2007, $1.6 trillion (₹100 lakh crore) in 2014, and crossed $2.9 trillion (₹200 lakh crore) in 2020. The momentum continued with $4 trillion (₹300 lakh crore) in 2021, and in February 2024, NSDL surpassed $5 trillion (₹400 lakh crore) in custody value.

1 thought on “NSDL Business Model, Revenue, Expenses, and Future Outlook”