The meeting is expected to be very tense, as the Trump administration is constantly pressuring the Fed members to cut interest rates so that liquidity flows into the economy. This would encourage people to borrow more and support economic growth.

The fed policy is expected to gain significant attention today, as it is set to begin, and the tie will act as a forecaster to draw conclusions. This is related to the Fed interest rate, and it’s likely to take some important steps. The meeting had already started yesterday and will conclude today, being a two-day event.

However, despite all this, the Fed members are being extremely cautious due to the ongoing situations and global concerns related to Trump and his tariff policies.

Since the time Trump took office as President, the Fed has not made a single rate cut during those years. The last time the Fed made a cut was in December 2024, when it reduced the rate by 0.25%, from 4.75% to 4.50%.

High Inflation and Tariffs: Why the Fed Won’t Cut Rates

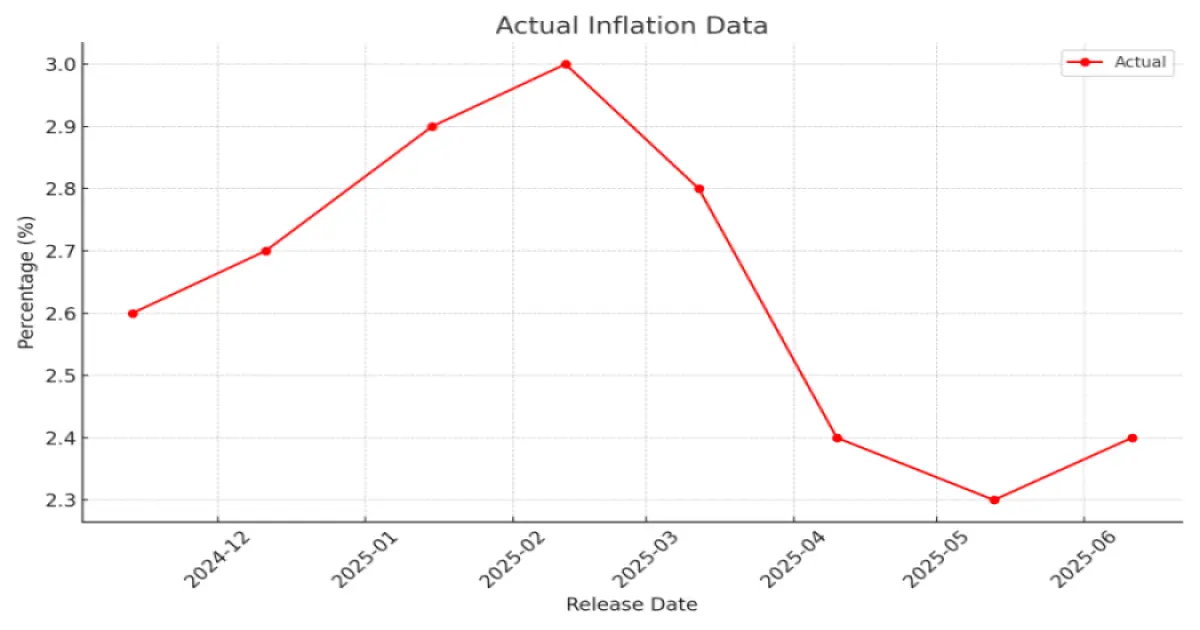

Fed has maintained a steady stance, avoiding any risky moves that could trigger inflation. As a result, inflation has remained under control, with recent data showing that it came down to around 2.4% in the latest month.

There is an impression forming that a slowdown might occur, but concerns are arising due to global tariff policies implemented by some administrations. Because of this, there is a possibility that inflation could rise, and the economy might suffer. That is why the Fed is consistently maintaining a steady approach.

If you look at the recent data on U.S. inflation (CPI), it was around 2.9% in December. In January, it increased to 3%. After that, it gradually cooled down, reaching a low of 2.3% in April. However, in May, it rose again by 0.4%.

But it is still higher than the Fed’s target of 2%. In earlier statements, Jerome Powell has repeatedly stated that they aim to bring U.S. inflation back below 2%, which is the core target of the Fed members. That is why they are consistently keeping interest rates high, and unless significant changes occur, probably they are not going to lower the rates.

Currently, the Fed has seven members who make policy decisions, and all of them have one vote each. The decision on a rate cut is made based on the majority vote. The important thing here is that if today’s meeting results in a 0.25% rate cut, it will create positive sentiment for the U.S. economy.

According to the report, the consensus is that since inflation remains high—above 2%—and tariff concerns are still active, the Fed is expected to remain cautious. The U.S. has only finalized a trade agreement with the UK, and no other major trade talks are currently in progress.

Since July 9 is the final date for the current administration to conclude the discussions and resolve key issues related to the tariff talks, the Trump administration might once again impose reciprocal tariffs or take various steps to increase pressure on other countries regarding trade negotiations.

This is very important, as major trading partners are not showing significant progress. While China has reached short-term deals with the USA, the European Union is not offering fair or favorable terms to the USA. As a result, the overall trade deal is still not progressing, and countries like India have also not reached any conclusive agreements.

Impact of fed decision on india

If interest rates in the USA return to previous levels, there is a strong possibility that FIIs (Foreign Institutional Investors) might prefer to invest in the USA due to relatively higher interest rates. In that case, they are likely to avoid investing in other countries. However, if interest rates in the USA decline and become lower than those in India, then FIIs may shift their capital to India in search of better returns.

This will also have a direct and positive impact on India’s IT sector, which has significant business exposure in the U.S. Most Indian IT companies earn more than 50% of their revenue from the U.S., so this development could benefit them greatly.

Additionally, Trump’s 90-day proclamation period is set to end on July 9, which is also a significant factor keeping the Fed cautious. What’s more important is how they forecast the upcoming period regarding rate cuts. If a rate cut actually happens, it would be positive for the markets. Moreover, the comments made during the announcement will also be crucial.

1 thought on “Fed policy begins today; Impact on Indian market”