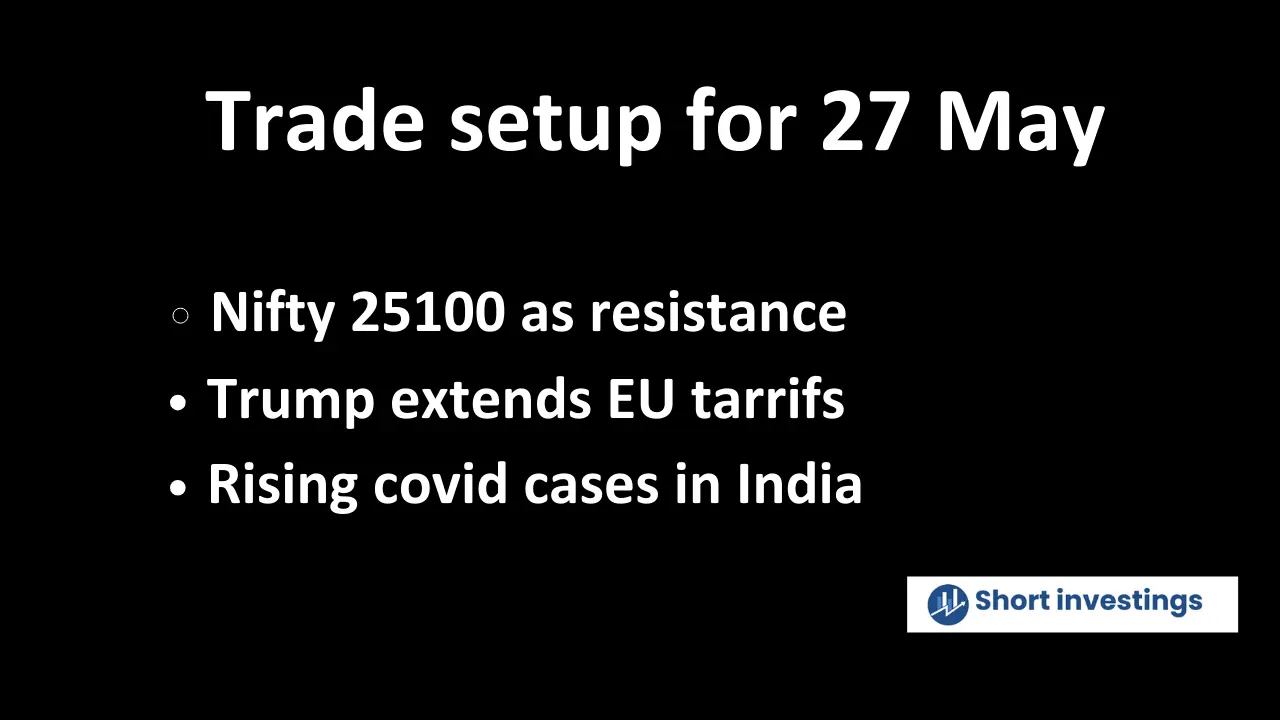

The market has been showing a mix of bullish and flat movements recently. In today’s trade setup, the market opened slightly bullish and then made a strong move to the upside, reaching levels above 25,000. After that, it attempted to retrace and gave up most of its gains, pulling back near the opening levels. Following that, it showed a slight mix of bearish and bullish behavior.

Nifty has closed above the 25,000 level, indicating strength. This move was followed by a retracement. It came after the announcement by President Trump, who had earlier stated plans to impose tariffs on the European Union. Following this development, the market showed mixed movements but still managed to gain nearly 150 points on the upside.

Global market analysis

Trump extends EU 50% tariffs

President Trump has announced a revision of the date for imposing a 50% tariff on the European Union. The tariffs, which were initially scheduled to take effect in June, have now been postponed to July 9. This decision came after a call with the European Commission President, Ursula von der Leyen.

Following this, the next day saw futures posting positive gains, recovering all the previous losses. Moving forward, much will depend on how things develop. The European Union is expected to push harder for better trade negotiations. It is believed that the Trump administration’s approach toward the EU is a strategic move—using pressure tactics to bring the EU to the negotiating table and work toward a more practical and effective trade deal.

Trump on Russia strike – gone absolutely crazy

Russia has launched heavy strikes on Ukraine’s capital, Kyiv, with reports indicating intense attacks near the main airport. These actions come even as diplomatic talks are underway, raising concerns globally. Despite these escalations, a surprising development occurred—Trump reportedly said that Putin has “gone absolutely crazy,” calling the actions unacceptable. On a more positive note, both Russia and Ukraine have conducted a prisoner swap, exchanging nearly 1,000 prisoners. While the situation seems chaotic, this exchange is seen as a step forward amidst the ongoing conflict.

It seems that Russia wants to take control of more Ukrainian territory in order to strengthen its position and secure a favorable deal. President Putin may be using this as a strategic move to reach a settlement that benefits Russia. While the conflict continues, any eventual agreement would likely require Russia to make significant concessions as well.

Domestic Market Analysis

Rising COVID Cases in India

Recent reports indicate a surge in COVID-19 cases across various cities in India. Delhi has issued an advisory in response to the rising numbers, while Kerala is also reporting a significant increase in cases. Currently, around 1,000 active cases have been registered. However, there has been no major advisory issued by the central government so far.

Early reports suggest that the chances of hospitalization remain low—around 5%. Given the mild nature of these cases and the lack of strong central intervention, it appears that the impact on the market will be minimal at this stage.

If the situation escalates significantly—with a sudden spike in cases in any state or a sharp rise in hospitalizations—it could lead to a series of advisories and renewed concerns. Moreover, if the central government issues an official statement or warning regarding the COVID-19 wave, it could trigger a negative reaction in the market. Such developments may cause panic among investors and result in short-term volatility or a market correction.

Monsoon Impact on the Economy and Markets

The Indian Meteorological Department (IMD) has reported that the monsoon is arriving earlier than previously expected. It is likely to begin in Kerala soon, marking an early onset. This is one of the earliest arrivals in nearly 70 years, indicating a significant shift from the usual pattern. The early monsoon could have notable implications for agriculture and overall economic activity.

Heavy rainfall has also been observed in Delhi and several southern states. This creates a mixed outlook from a stock market perspective. On the positive side, an early and strong monsoon can lead to a good crop season, which would benefit the agricultural sector. Improved rainfall also boosts water reservoir levels, ensuring better water availability in the coming months.

However, excessive rainfall could also lead to flood-like situations in some areas, which might disrupt normal life and agricultural activity. Overall, if the monsoon is well-distributed and not extreme, it would be a strong positive for the Indian economy—especially considering agriculture’s significant contribution to GDP. A healthy monsoon season can enhance rural income and boost consumption, supporting broader market sentiment.

Mixed sector gain in market reaction

Recently, the market has shown mixed and uncertain movements. Earlier, we discussed that the IT sector could be impacted if the proposed tariffs by the European Union take effect starting June 1. This suggests that short-term business prospects might be affected. Looking at the index-wise data, Nifty India Defence has contributed around 1%, along with similar 1% movements in the Nifty IT and Nifty Metal indices.

FII and DII Data Analysis

FIIs are not showing the same level of enthusiasm as they did earlier in the month. In today’s session, FIIs bought around ₹135 crore in the Indian equity market, while DIIs contributed approximately ₹1,745 crore. This indicates that the market may be factoring in or discounting certain developments, which is relatively impacting FII participation.

However, if we look at the data from previous weeks, FIIs showed stronger confidence at lower levels. For instance, last week they made significant purchases—nearly ₹8,000 crore and ₹5,000 crore on different days. In contrast, this week’s lower activity suggests a reduced momentum, which is also contributing to the Nifty’s relatively soft movement.

Nifty 50 Technical Analysis

In the past few trade setups, we mentioned that the 25,000 level would act as a strong resistance. That’s exactly what we’re seeing now — the market is attempting to reach this level but has yet to close above it. It appears that 25,000 is becoming a key hurdle, almost forming a handle at this zone.

If we look closely, the news flow has turned more positive, especially regarding trade deals and other macro developments that hadn’t contributed much to the recent rally. This suggests that a breakout above 25,100 could happen in the near term, potentially paving the way for Nifty to approach its all-time high in the 26,150–26,300 range.

If we take a closer look at the support and resistance levels of Nifty, the 25,100 zone still appears to be a key resistance. However, this resistance seems relatively weak and could likely be broken in the near term. On the support side, we are keeping a close watch on the 24,600 level, which remains an important area of interest.

Conclusion

It appears that Nifty has already priced in much of the sectoral performance, and now the market is in need of fresh triggers. A potential trade deal with the USA could act as a strong catalyst, likely leading to a sharp move in Nifty 50 and possibly pushing it toward its all-time high in the short term.

For now, the 25,100 level remains a key resistance. If this level is breached, it would signal a positive shift in sentiment and could set the stage for further upward momentum.