The market is making a sharp recovery after hitting a low of 24,400, which acted as a resistance, as things are cooling down and the reaction to the Israel-Iran escalation is stabilizing for now.

In today’s market, Nifty 50 has gained nearly 227 points on the upside, reaching close to the 25,000 level again. However, it has not yet closed above the 25,000 marks but has come very near to it.

Global Market Analysis

Israel- Iran tension escalation

There are reports suggesting that Iran is seeking mediation from Oman, Qatar, and Saudi Arabia, as it does not want the situation to escalate further. Additionally, reports indicate that Israel is working on a long-term plan to completely eliminate Iran’s nuclear program. They are making long-term preparations for this goal.

If Iran is truly seeking mediation and things go in the right direction, then it would likely be a good sign. However, the major concern remains the nuclear program. If Iran fails in its nuclear ambitions and avoids making enemies out of all the surrounding nations, then there is a strong possibility that the war tensions might ease, which could be taken as a positive signal by the markets.

On the other hand, if any major escalation occurs—such as an attack on oil facilities or disruption in the Strait of Hormuz—then things could turn negative, and the market is likely to react sharply.

Nasdaq gains ahead of fed policy

Nasdaq up is in a rising trend. After falling nearly 280 points due to the Israel-Iran conflict, the stock continued its decline in Friday’s trade. However, it showed a strong recovery in today’s session, gaining nearly 300 points and reaching around 21,950. It is showing consistent growth, and if it continues to follow this momentum, more upside could be seen.

Despite this, the market is still uncertain about the full impact of the ongoing conflict, especially since crude oil prices are not rising significantly. Yet, the concern remains active in the background.

The market is also reacting positively and taking cautious steps ahead of the upcoming Fed policy meeting scheduled for this week. There is a high probability that the outcome will be taken positively as inflation increase lower than expected, and this is likely to be reflected in the reaction of the Nasdaq.

Domestic Market Analysis – PM Modi’s Foreign Visits:

After holding in-depth discussions about investment and manufacturing capacities in India with leaders from the European Union, Switzerland, and Sweden, Prime Minister Modi is now set to visit several countries. He will attend the G7 summit in Canada and also visit Cyprus and Croatia.

These visits are focused on strengthening geopolitical ties and addressing regional concerns. Additionally, they carry significant importance in terms of boosting trade and attracting foreign investment into India.

iPhone Exports Rise: Strong Momentum for “Make in India”

Recent data suggests that Foxconn exported nearly 97% of India-made iPhones to the United States during the March–May quarter. This is a significant development, reinforcing earlier remarks made by Apple CEO Tim Cook, who stated that the company plans to manufacture all iPhones sold in the U.S. within India.

This marks a major boost for the “Make in India” initiative and builds strong confidence among global manufacturing companies to expand their production base in India.

Additionally, a recent report states that Apple’s vendors have achieved nearly 20% domestic value addition in India. This further indicates that Apple is on track with its goal to shift a major portion of its manufacturing for the U.S. market to India, highlighting steady progress toward its long-term production targets.

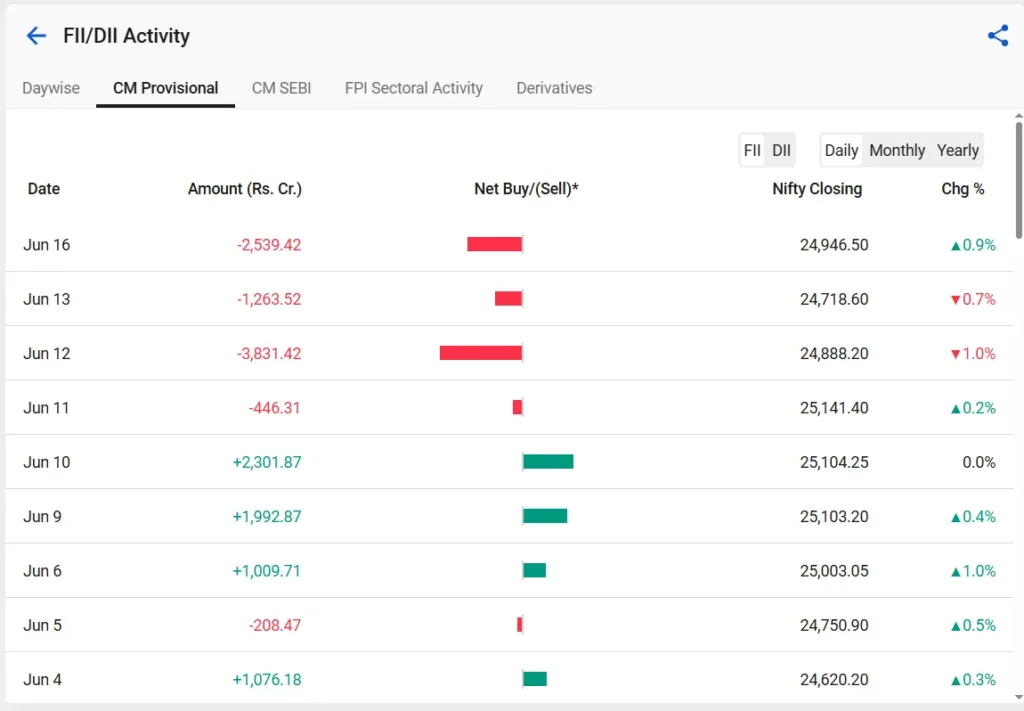

FII and DII Data analysis – Constant Selling Despite Market Gains

Foreign Institutional Investors (FIIs) have continued their selling streak in the Indian equity market, offloading nearly ₹2,539 crore—even as the Nifty gained more than 200 points and the Bank Nifty surged over 400 points.

This continued selling trend raises concerns, especially in light of upcoming events. On the other hand, Domestic Institutional Investors (DIIs) have shown strong buying support, purchasing shares worth around ₹5,780 crore, which has helped stabilize the market.

However, the market remains cautious due to the potential impact of U.S. tariffs expected next week and the ongoing geopolitical tensions. These factors could have a significant influence on market sentiment in the days to come.

Nifty 50 Technical Analysis – Eyeing the 25,200 level

Nifty 50 is forming a clear and strong technical pattern. It recently retested the 24,500 level, which we previously highlighted as a crucial support zone. Now, it is approaching a major resistance level around 25,000, a level we had identified earlier.

If we look at the key resistance zone, the range between 25,200 to 25,300 is going to be important in the upcoming sessions. This zone could act as the next hurdle for the index.

So far, this week, Nifty has shown progressive strength, successfully breaking past previous minor resistances. If the index manages to sustain momentum and break through this resistance zone, we could see a new all-time high in the near term.

The technical outlook remains bullish, but market participants should also watch for key global cues and any sharp reactions, especially related to geopolitical or macroeconomic developments.

Conclusion

Tensions between Iran and Israel remain elevated, as both sides are actively pursuing aggressive stances. However, there is still a possibility for positive developments—especially if leaders like Donald Trump and key Western Union allies manage to make progress on restarting nuclear deal negotiations.

Any such diplomatic breakthrough could lead to significant market movements in either direction.

Meanwhile, this particular week may prove to be a decisive one. There’s also optimism around Jerome Powell’s upcoming statements, especially after the recently released U.S. CPI data came in better than expected. If supportive monetary signals emerge, we may see strong upward momentum in the IT sector, which could play a major role in driving further gains in the Nifty 50.