The market is now assessing that the negative impact of the US tariffs on India, imposed by the Trump administration, has reduced by nearly 50%. The market has observed the situation and sees that the impact of these tariffs is unlikely to be significant for much longer and may probably be resolved soon. In today’s trade setup, the market showed a sideways to bullish movement, gaining over 130 points on the Nifty 50 index. It closed above the 24,600 level, slightly below the previously suggested resistance of 24,700.

Stock Market News Analysis

Scott Bessant on the Fed Rate Cut

Recent inflation data has come in at a contained level, despite spikes caused by tariffs. According to Scott Bessant, this provides a strong case for a potential rate cut in the future. Bessant stated that the Fed should consider cutting rates by nearly 150 basis points, or possibly even more. These developments have sparked debate regarding future monetary policy, while the U.S. administration is reportedly pushing for changes to the Federal Reserve’s leadership, including the possible appointment of a new chairman.

It has been three months since the tariffs were put into effect, yet inflation has not surged. In July, inflation came in at 2.7%, which was close to expectations of 2.8%. This is significant as it shows that inflation remains relatively stable, although it is still above the target level of 2%.

The success of the trade will now depend on how exports and imports are affected, as well as the upcoming U.S. non-farm payroll data. These will be key indicators in the near term and will also help in making a comprehensive assessment of the Federal Reserve’s future policy decisions.

US Threatens Russia with Tariffs if Ceasefire Talks Fail

The U.S. may impose tariffs on Russia if ceasefire talks fail. U.S. President Donald Trump and Russian President Vladimir Putin are scheduled to meet in Alaska this Friday, an event that will be closely watched by global media.

Recently, the U.S. President held a combined virtual meeting with European Union and NATO members, as well as Ukrainian President Zelensky, ahead of the key summit. During this meeting, Zelensky reaffirmed that the U.S. continues to support Ukraine during these critical times. At the same time, French President Emmanuel Macron indicated that there could be a possibility of land swaps as part of a potential deal.

According to reports, Russia continues to hold its previous positions in the negotiations. These developments are particularly important from an Indian perspective, as India has faced an additional 25% tariff related to these geopolitical tensions.

Indian FTA Talks with Oman Concluded

Oman is a strong trading partner for India in the Arabian Gulf. If a Free Trade Agreement (FTA) is finalized, it would become a key single-country FTA for India after the UK, strengthening bilateral trade relations.

At the same time, India is also exploring FTAs with Peru and Chile, countries with significant lithium reserves, which are of strategic interest. Additionally, discussions are ongoing for a free trade agreement with the European Union to further enhance trading relations.

According to Indian officials, India has concluded talks with Oman regarding a Free Trade Agreement (FTA), which is expected to provide a major boost to bilateral relations. Currently, trade between the two countries stands at around $10 billion, with exports of approximately $4 billion and imports of $6 billion. If the FTA is implemented, it would create a strong, low-barrier trade framework between the two nations.

Rate Cut in Focus as inflation data come lower

India’s inflation data has come in significantly lower than expected, fueling forecasts of a potential rate cut in the near future. Currently, the interest rate stands at 5.50%, and the recent inflation figures suggest there is scope for further easing. Analysts are anticipating that there could be two rate cuts in the remainder of this year, depending on how the data evolves. There is also the possibility of additional cuts, potentially two or three, if economic conditions support such a move.

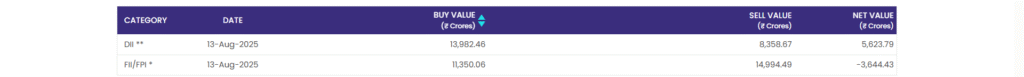

FII and DII Data Analysis

Foreign Institutional Investors (FII) have continued to be net sellers in August, showing a cautious approach despite market support. In today’s trade, FIIs sold nearly ₹3,644 crore, while Domestic Institutional Investors (DII) purchased ₹4,623 crore. This indicates a net positive inflow of funds, but the persistent FII selling remains a key concern.

Nifty has managed to hold support above 24,400 despite FII selling, supported by DII participation in the market. Going forward, market focus will remain on FII and DII activity, as well as global developments such as the Trump-Putin meeting. Positive outcomes from these events could potentially reverse FII selling and boost bullish sentiment, though the situation remains uncertain at present.

Nifty 50 Technical Analysis Outlook

The market is experiencing pressure from the upside while also finding support on the downside, as many levels have already been discounted. Based on technical analysis, Nifty is likely to face resistance around 24,700 due to the sideways trading zone. On the short-term basis, support is expected near the 24,350 level.

If the meeting between Trump and Putin yields positive results, it could lead to a gap-up or gap-down opening in the market. This will be a key factor to watch in Monday’s trade setup, as the market reacts to the outcome of the meeting. Such developments could drive significant market movements in the near future.

Conclusion

There are significant possibilities in the market, which is currently under pressure and trading in a sideways zone. Positive outcomes from the upcoming meeting between the Trump administration and President Putin could lead to notable changes. This event is important, as it may influence the future direction of the secondary market and the policies implemented by the Trump administration regarding engagement with Moscow.

1 thought on “Trade Setup for 14 August: Nifty Likely to Remain Range-Bound as Trump Threatens Sanctions if Ceasefire Talks Fail”