The pressure from the market on the upside is in an active mode, as there is no progress between India and the USA regarding trade negotiations. These matters are becoming more crucial, and until anything happens regarding the tariffs, we will probably see the market unable to gain strength for an upside movement. In today’s trade setup, the market made a nearly 100-point downside movement. It opened and tried to reach higher levels, but from the upside, it faced resistance and ended up losing 100 points.

Stock market news analysis

US Inflation Data Brings Positive Surprise

The US inflation data has come in lower than the forecast, which is a very good point, as we had analyzed that if the data came in above 2.8%, it would be seen as negative. However, US inflation has not surged as much as expected by analysts and has come in at nearly 2.7% in August, even as tariffs are making progress. At the same time, following this, the NASDAQ has risen nearly 250 points and reached a high of 21,640. This is a remarkable development for the US economy and will also bring more strength prospects for the future of monetary policy.

Addressing the data, the U.S. President said that they are making the tax boom a great one and also explained that Jerome Powell is doing very bad things for the economy, which is costing the U.S. economy heavily. They also suggested that these kinds of tariff efforts are going to be very good for the future as well.

Russia-Ukraine Developments and Ceasefire Talks

Russia and the U.S. met in Alaska, and Russia is making advances in the territory of Ukraine, as it will help them conduct negotiations in an easier way. Russia has advanced into the mining town of Dobro Pila, which is a move toward further advancement. At the same time, Ukraine is also making slow advances in a couple of Russian-occupied territories. Both sides are taking very crucial steps.

Several European Union leaders have suggested that Ukraine should have the freedom to decide its own future, giving the Ukrainian people complete freedom to determine their path. Germany has also announced its intention to hold a meeting regarding ceasefire talks, bringing together European Union leaders, NATO members, the U.S., and Ukraine. All these meetings are being organized by Germany. These are the key steps being taken, and Trump is also in a rush to push for a ceasefire so that his global ambitions as a “peacemaker president” can continue.

US-India Tariff Tensions

This trade negotiation is going to be crucial because, in the U.S., there are continuous questions being asked to the trade negotiation team about why tariffs were imposed on India for buying Russian oil, while China has not faced the same treatment. That kind of pressure is building, and it is also deteriorating U.S.-India long-term ties.

At the same time, both the U.S. and India are aware that several jobs are at risk due to this issue, and maintaining long-term business with the U.S. as a key partner is important. India is being somewhat neglected or sidelined in this tariff war, with the U.S. imposing one of the highest tariffs—50%—on India, along with Brazil.

China Receives Tariff Relief

TACO on China tariffs: China has received some relief, as the tariffs that were previously nearly 30% have been extended by U.S. President Trump. This is seen as a very good development for their peers, as they have avoided significant tariff increases.

However, questions remain, as Trump had earlier told reporters that more tariffs could be imposed on other countries, including those importing Russian crude oil. This is a key issue, as China has not faced any new tariffs, but India has. These kinds of questions are arising and are negatively affecting the future of India-U.S. relations. There is also a kind of internal resistance building against these measures.

India’s CPI Data Shows Positive Outlook

India has announced the CPI data, which has turned out to be very crucial, coming in at nearly 1.55% compared to the forecast of 1.76%. This is a major development for the Indian economy, as it aligns with expectations.

At the same time, there are expectations that India’s inflation could remain under control, which is also providing a strong push for another rate cut in the future. This is important for supporting economic growth. If inflation remains under control, that will be a key positive factor. In the previous RBI meeting, Sanjay Malhotra also stated that they believe inflation could be kept in a controllable range, but at the same time, they expect some rise in inflation in the coming months.

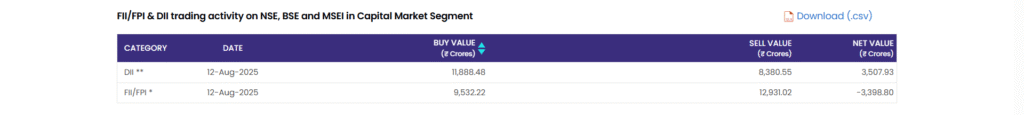

FII and DII Data Analysis

FII has been a net seller even today, selling nearly ₹3,398 crore, while DII has been a net buyer of ₹3,507 crore. This consistent buying from DII continues, but at the same time, FII has been making massive sales in August, having sold more than ₹18,000 crore so far this month, which is a very high number.

On the other hand, DII has provided key support by buying nearly ₹46,000 crore worth in August, supported by rising SIP inflows. In July, SIP contributions rose to more than ₹28,464 crore, which has been a key boost for DII.

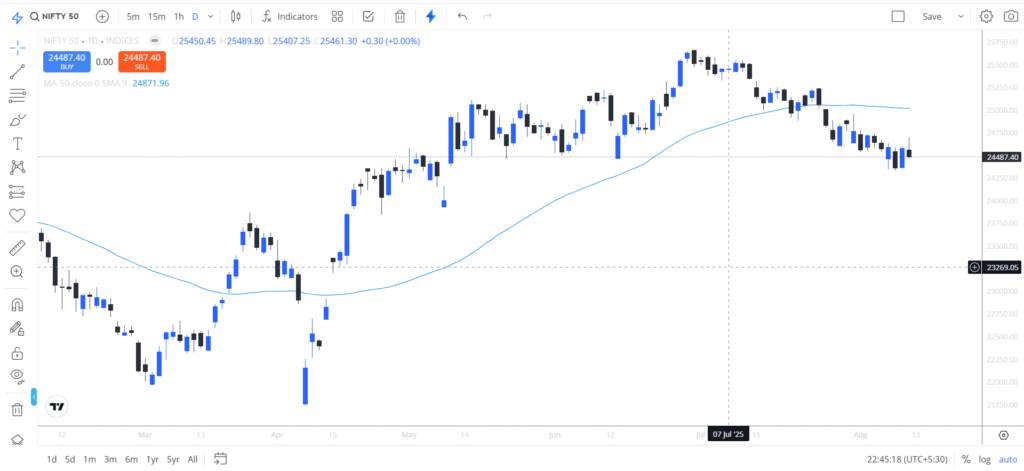

Nifty 50 Technical Analysis

The market is facing significant pressure from the upside. After a strong bounce and upside movement yesterday, with a gain of nearly 221 points, today the market faced more upside pressure and closed nearly 97 points down at 24,487, below the 24,500 level. The key support for the Nifty is considered to be around 24,350, while today’s high will act as a major near-term resistance, which is around 25,523. These are the support and resistance levels for the short term.

At the same time, key factors to watch include the U.S.-India trade negotiations and the outcome of the Trump-Putin meeting in Alaska. If positive developments occur and the U.S. President makes encouraging remarks, it could lead to lower tariffs, which in turn could give a strong boost to the Nifty 50.

Conclusion

The market is in a phase where things are not looking great, as it is facing pressure from the upside. At the same time, recent developments have not brought much escalation as the market expected, and even if escalation happens, it may not be practically possible to act on it.

This is why the market has already discounted the news. For now, the market is neither falling sharply nor rising significantly, resulting in sideways movement. At present, the 24,350 level is considered a strong support, while 24,700 is seen as resistance. This zone will be important for the time being.

1 thought on “Trade Setup for 13 August: Nifty Likely to Find Strong Support as Inflation Comes in Lower Than Expected”