Trade setup for 01 July: The market is moving sideways for now, as it had previously seen four consecutive days of upside in the candles and the Nifty 50. Today, it has recorded a loss of more than 100 points, closing around the 25,500 level. This suggests that the current movement appears sustainable.

The key focus is on the upcoming trade talks taking place in the USA, as the Indian representatives are there to lead and conclude the discussions. With the date of July 9 approaching, this will provide a forecast for upcoming developments.

Global and domestic news analysis

Major Developments in the US Senate

Significant developments in trump big beautiful bill, which are currently considered a major contribution, as many factors are involved. The final steps have been taken in the Senate as earlier it has got the clearance from house of representative and the bill is moving forward with the efforts of the trump administration, which is trying to take control of the situation.

This has become a key point, as the bill involving 1000 pages has now turned into a topic of debate, with strong opposition arguing that it could harm the US economy. A self-imposed deadline of July 4 has been set by Trump, who has already urged people to skip the holiday if necessary to pass the bill and implement it as he expects.

India-US Trade Negotiations Progress

As of now, Indian officials who are actively engaged in conversations and negotiations regarding the trade deal with the US are in the USA. They are working to finalize the negotiations properly and conclude the deal before the July 9 deadline.

According to sources, they have extended their visit recently as they want to reach a quicker conclusion. Steps are being taken, and if things progress positively and a deal is reached with the USA, it will enable very good business between the two countries. This would have an excellent impact on the markets of both nations.

US-Canada Trade Tensions Over Digital Services Tax

Earlier, Trump stated that they are going to scrap the ongoing trade negotiations with Canada, as Canada has imposed a tax on digital services. This tax would significantly harm big US companies like Google, which would be most affected. In response, the president announced that trade talks with Canada would be halted.

This move also impacted Canada, leading them to indicate they would scrap this kind of tax as well. They have said they will resume trade negotiations. By putting pressure on countries during trade deals, Trump has previously taken similar steps, including imposing key tariffs, which have advanced US interests and created an impact.

Tariff Extension Deadline and Global Market Impact

A statement has also come from US President Donald Trump indicating that he will not extend the tariffs. Because of this, the markets could be impacted, as Trump had implemented reciprocal tariffs set to expire 90 days after April 9, which brings the deadline to around July 9. If this deadline passes without an extension, it could have negative effects on the global economy.

Global countries have not yet taken significant steps in response, leading to concerns of a potential negative move. Wall Street is expecting that there might still be a reprieve from the Trump administration. Additionally, major countries and blocs like the European Union, China, and Canada are working to make trade negotiations successful, which could limit the negative impact on markets like the Nasdaq.

Modi’s Official Visit to Ghana to Boost Trade Relations

Modi has made an official visit to Ghana today to strengthen trade relations with one of the fastest-growing West African countries. India is working to improve ties with Ghana, a country with which it already shares good relations. Ghana is also a major source of gold, supplying about 70% of India’s gold imports, as it has significant gold mining operations.

India, being one of the world’s largest retail consumers of gold, sees this relationship as very important, and discussions related to gold trade are also part of the visit.

Nifty 50 Technical Analysis Outlook

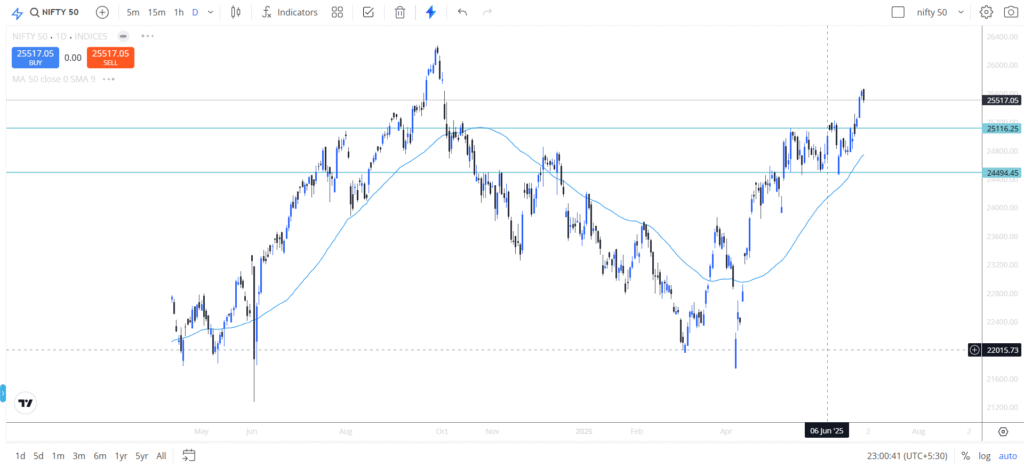

Nifty 50 has been making gains for four consecutive days, but today it showed some weakness, recording a loss of nearly 12 points and closing around the 25,570 level. Earlier, we discussed that the index could potentially reach an all-time high due to the positive environment within the country and the favorable technical outlook. Currently, the key resistance level is around 26,300, which is close to the all-time high made in September.

Looking at the technical outlook, we can see that the 50-day moving average is pushing the market upward, currently sitting around the 25,000 level. Another important point is that the recent rise has happened sharply, without forming solid supports nearby. However, the nearest support level is considered to be around 25,300. In conclusion, we can expect that the 25,300 level will act as support, while the previous day’s high at 25,670 will serve as resistance.

Conclusion

Indian officials have extended their visit to the USA, and trade negotiations are making progress. Previously, Trump had stated that India is very close to reaching a deal in some sectors, though not a comprehensive agreement yet. If a deal is reached, it would follow similar recent deals between the US with the UK and China, making India potentially the third major country to finalize an agreement.

This would be a positive development, as India is exporting more iPhones and other electronics to the USA, which could boost manufacturing and attract more global investors. As a result, we could see a stronger positive impact on the Nifty 50 compared to other indices, and the index may continue its upward movement, possibly approaching new all-time highs in the near future if the deal is signed with favorable terms.