The bullishness of the Nifty50 continues, as it has recorded consecutive gains above the 25,000 level. Today, it attempted to close near the 25,200 level, but after facing pressure during the middle of the session, it managed a modest gain of 37 points, closing at 25,141.

Nifty opened slight gap up following the US-China trade negotiation meeting and has sustained that level, as it did not show any downward movement and continued to push higher. The previously identified short-term support around the 25,000 level is showing good strength, as the market held that level and closed with a slight gain.

Global Market Analysis

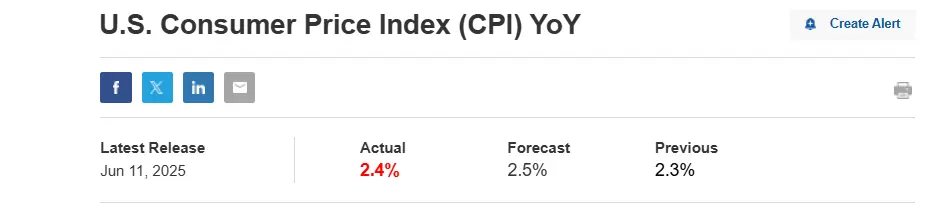

U.S. Inflation Data announce

The U.S. has recently announced the inflation data for May, which turned out to be encouraging as it came in lower than expected. While the forecast was around 2.5%, the actual data came in at 2.4%, below the projections. This development is a positive sign for the consumer market, as it puts significant pressure on the Federal Reserve and brings attention to the possibility of a policy shift in the upcoming meeting scheduled for next week.

Highlighting the same data, Trump stated that very good numbers have come in, and he mentioned that this will help in lowering interest rates, which would reduce the interest cost on debt. This is a significant development, as the Trump administration has been consistently pushing the Federal Reserve to cut interest rates. This is an important and positive signal, especially with the upcoming monetary policy meeting scheduled for next week. The outcome of that Fed meeting will be crucial.

U.S-China Trade Negotiation Meetings

In London, a meeting is being held regarding trade negotiations between the world’s two largest economies, the U.S. and China. Outcomes have emerged from both sides. Trump stated that a U.S.-China trade deal has been finalized, with the U.S. securing a 55% tariff and China receiving a 10% tariff in return—an arrangement considered highly significant and progressive from the U.S. perspective. Additionally, the U.S. announced that China will begin exporting rare earth materials, which are crucial for the EV sector, and in return, the U.S. will fulfil its part of the agreement as discussed.

However, the deal has not been finalized yet, as the U.S. and China have only officially agreed on a framework, and Trump and Xi still need to sign the agreement. This is still a positive development, and expectations are high in Beijing. Economists also believe that more rounds of talks are likely to take place in the near future, with clearer outcomes expected.

Domestic Market Analysis

CAPEX to Be Doubled in 5 Years, S&P Report

A recent report published by S&P has predicted that India is set to double its capital expenditure (CAPEX) to $850 billion over the next five years.

This is a significant development, with several key sectors expected to contribute, including power generation, oil and gas, airlines, steel, transmission, and telecommunications. These sectors are anticipated to play a major role in driving CAPEX growth during this period.

World Bank Retains India’s Growth Forecast

Due to the current fiscal year’s performance, India has recorded a growth rate of 6.5%. Meanwhile, projections from institutions like Nomura have predicted a slowdown in India’s growth for FY26. However, in this crucial period, the World Bank has retained its forecast for India’s growth at 6.3%, which is a positive development, especially in light of the better-than-expected Q4 GDP growth.

Several other institutions have also revised their growth forecasts for India. Fitch had earlier projected a 6.5% growth rate but has now revised it to 6.4%. Similarly, the IMF, which previously forecasted 6.5%, has lowered its estimate to 6.2%. UBS had earlier expected 6.3% growth but has now revised its forecast to 6%.

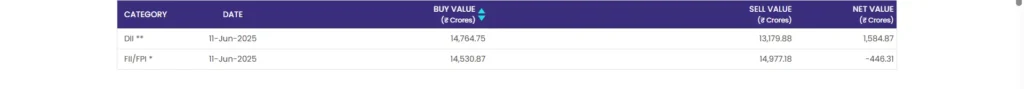

FII and DII Data Analysis

The consistent buying by FIIs over the past few trading sessions—worth more than ₹1,000 crore—came to a halt in today’s session, as FIIs turned net sellers with an outflow of ₹446 crore. This recent development contributed to the market moving slightly sideways today.

On the other hand, DIIs have continued their buying streak. Today, they bought shares worth approximately ₹1,584 crore. Since May 20, DIIs have been consistently buying in the Indian equity market, providing strong support to the growth and sustainability of the Nifty index.

Nifty 50 Technical Analysis – Outlook

The market is currently showing a highly sideways movement. In the June 9th trading session, the Nifty opened with a strong gap-up and sustained that level throughout the day, moving within a narrow range. However, it neither broke the day’s high nor the low, continuing the sideways trend.

This indicates that the market is stabilizing ahead of the RBI monetary policy outcome, which is likely the reason we are not seeing a strong breakout. From a technical analysis perspective, the 25,000 level is acting as solid support for now, while the 25,200 range is serving as a weak resistance. This suggests that in the near future, Nifty may test these levels again as per current analysis.

Conclusion

The market is currently moving sideways, with limited buying coming from both FIIs and DIIs. The primary reason for this sideways movement is the lack of a strong trade agreement or positive outcome between India and the U.S.

If any significant development emerges from those talks, the market could potentially move to a new level. Until then, the sideways trend is likely to continue. However, if FIIs make a strong pushwith buying worth around ₹5,000 crore or more, we could see Nifty 50 breaking the 25,200 level.

1 thought on “Market outlook for 12 June; Nifty 25200 and US inflation”