FII data has become very, very crucial for the market, as it helps the market sustain its levels. Even if new positive developments occur, alongside buying from foreign institutions, it gives more support to the market movement and helps it reach higher levels.

After seeing consecutive selling in the second half of calendar year 2024, Nifty lost nearly more than 17% from its top level. The continuous outflow of FIIs from Indian equities also remained significant in 2025, with around ₹20,000 crore withdrawn in the first quarter of the calendar year.

This selling was driven by rising interest rates in the USA, as inflation was not making good progress at that time. There was also uncertainty regarding the trade balance caused by the administration of President Donald Trump, which repeatedly stated in releases that they were going to implement reciprocal tariffs to earn more revenue and give tax cuts to consumers so the public would have more money to spend.

This kind of policy made things even worse, and concerns arose about what the impact would be and what actual policies would be taken.

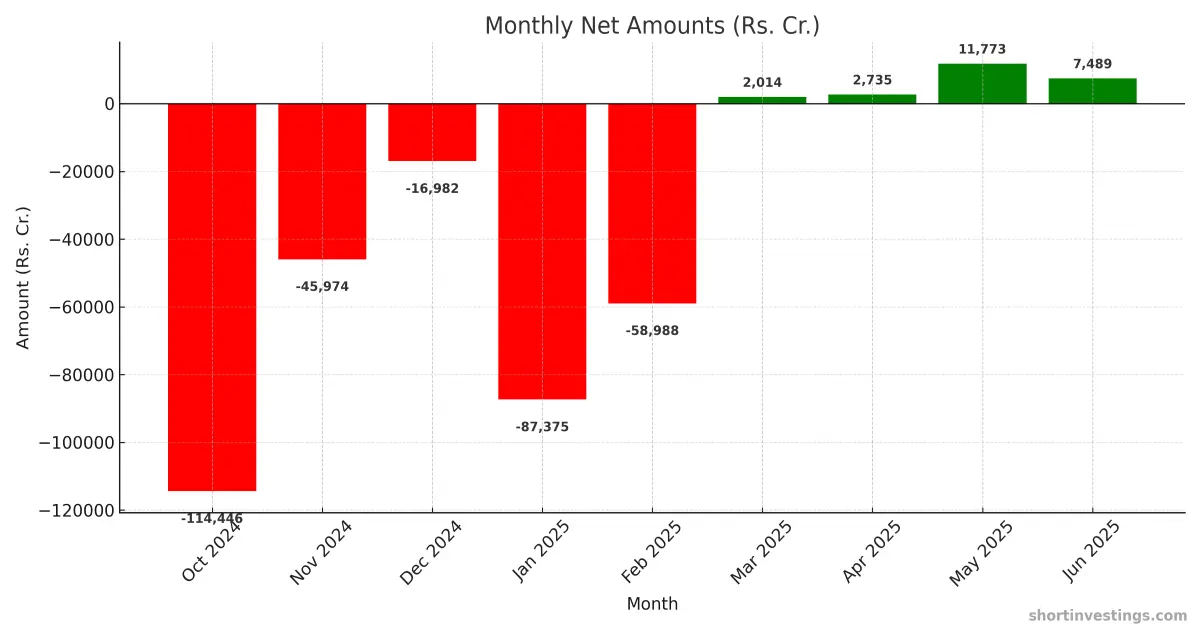

Selling from FIIs picked up sharply after the end of calendar year 2024. In October, massive selling by FIIs was seen, with nearly ₹1,14,445 crore sold in the Indian equity market. This trend continued with nearly ₹45,974 crore sold in November, ₹16,982 crore in December, and ₹87,374 crore in January 2025. Over these five months, total FII selling amounted to around ₹5,89,888 crore.

In March, after five months of massive selling, we saw neutral buying in March 2025, with net buying of ₹2,016 crore in equities. After that, April and May were also positive, with April seeing ₹27,350 crore of buying and May recording ₹11,773 crore. In the most recent month, June, net buying stood at ₹7,488 crore.

Earlier, such massive selling had not been seen, but ongoing developments started to have an impact as GDP growth forecasts were not showing progress because the second quarter GDP number came in at around 5.4%, which created negative sentiment about the future of India’s growth.

The main point is that in the past four months, we have consistently seen positive net buying on a monthly basis. However, this was not much expected, especially since earlier we saw massive selling figures like ₹50,000 crore and ₹40,000 crore, while recent buying numbers have been much smaller, with around ₹2,000 crore and the highest recent figure being ₹11,000 crore in May.

Positive net buying by FIIs is also a very important factor, as it helps the market remain sustainable. In the upcoming period, when the Fed announces its policy on interest rates, it will be a crucial time. Based on that, we can expect its impact on FII buying activity. The major reason we are still not seeing abundant buying is that policy concerns remain, with uncertainty regarding monetary policy.

India has not yet concluded any trade negotiations with the United States. Interest rates remain above 5%, which is not expected to come down until there is clarity on inflation and growth. Meanwhile, India is on a path to lower interest rates, but the situation is complex because investments in the USA currently offer higher returns compared to India.

Now, the key factor for future buying by FIIs will be whether trade negotiations between India and the USA turn out positively. Additionally, if the US Fed rate is cut substantially, it will likely have a positive impact on FII inflows into India.

1 thought on “FII Becomes Net Buyer in June, Marking Fourth Consecutive Month of Buying”