CAMS Business Model: As the Indian economy continues to grow and individual incomes reach higher levels, GDP per capita and the purchasing power of Indians are also increasing. This leads to greater savings among individuals and rising opportunities for saving and earning returns on investment, which continue to grow day by day. That’s where the mutual fund industry comes in. Many Indians are now eager to invest and earn further returns.

Additionally, mutual funds provide a seamless experience with low compliance requirements. This ease of access and liquidity makes mutual funds a better option for investment compared to FDs. They also tend to offer higher returns than bank fixed deposits and provide better flexibility and predictability than real estate investments.

In such cases, to ensure a seamless and convincing process for individuals to invest in mutual funds, companies like CAMS come into play. They provide excellent solutions for investors as well as fund houses, such as RTAs (Registrar and Transfer Agents) and others. All of this work is handled by CAMS in a very efficient manner, which helps streamline the entire process.

How CAMS play key role in mutual fund industry

CAMS operates as a QRTA (Qualified Registrar and Transfer Agent), registered with SEBI. Currently, only two QRTAs are registered with SEBI—CAMS and KFintech. As of now, SEBI has no plans to introduce more QRTAs in the near future.

The core function of CAMS is that any mutual funds must be registered with an RTA. This is where CAMS plays a crucial role. If you invest in any mutual fund, it must be associated with an RTA—and if that RTA is CAMS, then your mutual fund details will be visible in the CAMS application.

At present, CAMS handles around 68% of the mutual funds RTA market, meaning 68% of the total mutual fund AUM is registered with CAMS. This makes it a dominant market leader in the mutual funds industry.

For example, if you have mutual fund investments through companies like Groww, Anand Rathi, and Motilal Oswal, and Anand Rathi, Motilal Oswal use CAMS as their RTA while Groww uses KFintech, then your holdings with Anand Rathi and Motilal Oswal will appear in the CAMS app, and the Groww holdings will appear in the KFintech app.

This structure makes CAMS a highly reliable platform, and given its market dominance, it is expected to grow further in the coming years.

How cams make revenue

CAMS generates revenue through multiple channels, primarily linked to mutual funds transactions and its various subsidiaries. One major source of revenue comes from transactions involving AUM (Assets Under Management)—any purchase or redemption of mutual fund units results in a transaction fee that contributes to CAMS’ income.

Also read – CDSL business model

Additionally, lump sum investments and SIPs (Systematic Investment Plans) made by individuals also play a significant role in driving revenue.

Moreover, CAMS has several subsidiary companies such as CAMSPay, CAMSRep, CAMS360AI, CAMSKRA, and others, which contribute meaningfully to its overall revenue.

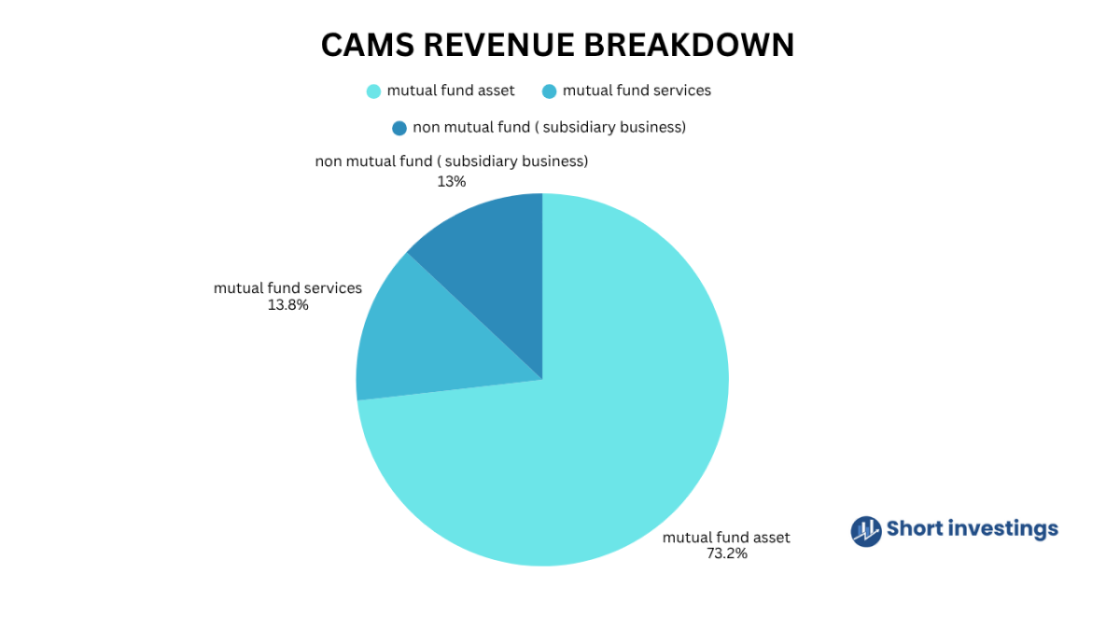

According to available data, approximately 73.2% of CAMS’ revenue comes from mutual funds asset-based services. About 13.8% comes from mutual fund non-asset-based services, and the remaining 13% is generated from non-mutual fund.

The majority of CAMS’ expenses come from employee-related costs, while the rest are categorized as other expenses, which include salaries and similar overheads. Employee expenses amounted to ₹469 crore, while other expenses stood at ₹301 crore. These are the major expenditures required for CAMS to run its business operations effectively.

Strength of CAMS Business Model

One of the key points to note is that CAMS’ revenue has been growing at a rate of over 15–25% annually. Additionally, it enjoys a strong operating margin of around 46%. This makes the company highly attractive, as it benefits from a near-monopoly, excellent margins, and consistent sales growth.

Moreover, as India’s GDP per capita and purchasing power continue to rise, along with increasing investment activity, there is likely to be significant growth in CAMS’ revenue in the coming years.

CAMS is considered one of the major leaders in the mutual fund industry due to its seamless registration services. This has led to growing importance and an increasing market share for the company. As a result, the majority of mutual fund companies prefer CAMS as their RTA.

To make an investment, there are several options that investors can choose from. They may invest in real estate, banks, fixed deposits (FDs), and many other avenues. However, we have seen that the mutual fund industry has become a very crucial part of investing in India. It has emerged as a prominent way to invest, especially for Gen Z and millennials these days, because it offers high liquidity—whenever an individual needs money, they can easily sell their mutual fund units and receive the funds within a maximum of two working days.

One of the key strengths of CAMS is its well-established infrastructure, which contributes to its strong operating margins. Currently, CAMS has only one significant competitor—KFin Technologies—offering similar services under SEBI’s guidelines.

Another important point is that SEBI has not indicated any plans to authorize additional QRTAs (Qualified Registrar and Transfer Agents) in the near term. Therefore, unless there are major regulatory changes in the mutual fund industry, CAMS and KFinTech are expected to remain the only key players. This gives CAMS a competitive edge over other companies in the sector.

Key role in capital market

It also supports Domestic Institutional Investors (DIIs) in increasing their participation in the Indian stock market. A stronger presence of DIIs helps ensure that the sovereignty of the market is maintained and not easily influenced or manipulated by a few foreign players.

Therefore, platforms like CAMS are extremely important for expanding financial inclusion. They enable individuals—especially those who are not deeply familiar with financial markets—to participate in wealth creation through mutual fund investments.