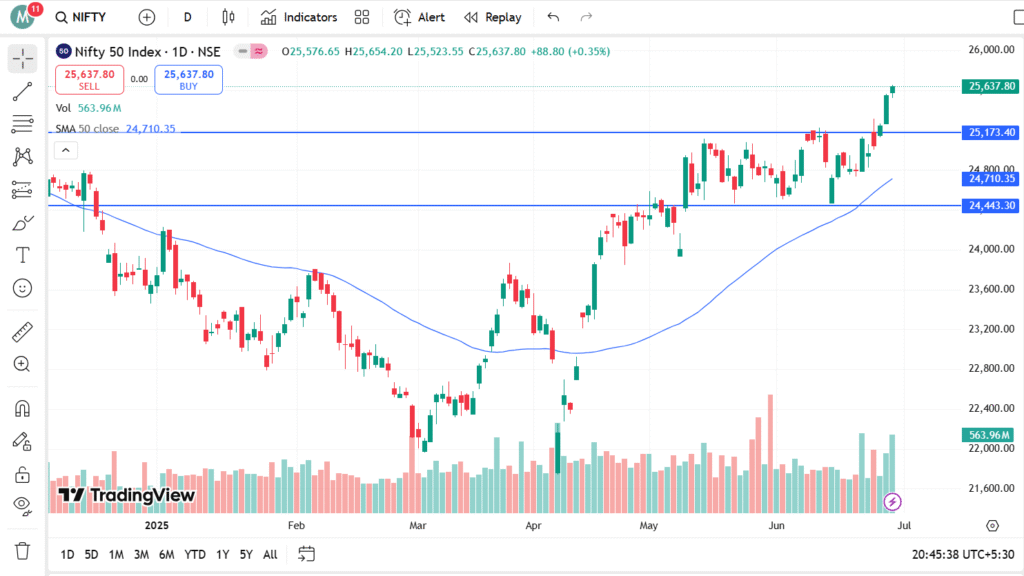

The Indian stock market has recently been demonstrating strong momentum, with the Nifty hitting new highs each day and closing near the day’s peak. This rally has seen the Nifty gaining nearly 1,500 points over four consecutive sessions, fueled by supportive global cues and positive domestic developments.

Investors have been buoyed by improving sentiment, rising confidence in the economy, and expectations of favorable policy decisions.

A Significant Turn in June – Sideways Phase Despite Positive News

The tide turned decisively after the Nifty hit a low near the 24,500 level in the June 13 trade setup. From this point, the market entered a strong upward trajectory, with the Nifty surging more than 2,000 points over the next 10 trading sessions. Mid-June was particularly notable, as the Nifty touched the 25,000 marks again, reflecting renewed investor optimism. Hopes of India finalizing a trade pact with the USA, along with expectations of upcoming rate cuts driven by moderating inflation, contributed significantly to this rally.

However, despite encouraging indicators, the market remained stuck in a sideways pattern throughout May and much of June. The Nifty failed multiple times to achieve a decisive close above the 25,000 level, consolidating between 24,500 and 25,000 for nearly 20 trading sessions. This prolonged consolidation phase highlighted investor caution amid lingering uncertainties surrounding global events and the delay in finalizing India’s trade deal with the USA.

One of the major factors keeping the market range-bound was rising geopolitical tensions. The situation in the Middle East worsened when the USA launched B2 bomber strikes on Iran, causing civilian casualties after UN watchdog reports accused Iran of non-compliance with nuclear obligations. These developments sparked fears of potential instability in the Strait of Hormuz, a crucial global oil supply route, which could trigger sharp spikes in crude prices.

Such a surge in crude oil prices would directly impact Asian economies dependent on oil imports. While India has diversified its energy sources since 2020 to reduce reliance on Middle Eastern oil, any disruption in the region still poses a significant risk to inflation and growth, increasing market volatility and limiting upward momentum.

Positive Economic Indicators Emerge

Amid these challenges, some positive economic signals have started to emerge. A fragile ceasefire in the Middle East has provided temporary relief to global markets, and leading international agencies such as S&P, the IMF, and the World Bank have issued encouraging forecasts for the Indian economy. These agencies project that inflation will be brought under control, supported by prudent fiscal and monetary measures.

Moreover, expectations of an upcoming rate cut by the Reserve Bank of India (RBI) are growing, as inflation shows signs of easing. The recent Cash Reserve Ratio (CRR) cut by the RBI is another positive step, injecting additional liquidity into the banking system and potentially boosting lending and economic activity. This combination of controlled inflation, easing monetary policy, and improving liquidity bodes well for India’s growth prospects.

Momentum for New Highs Builds

The market’s sustainable momentum is now supported by multiple factors. Stable crude oil prices, easing geopolitical tensions, and expectations of monetary policy support through rate cuts all contribute to an improving outlook. Inflation moderation further strengthens the positive sentiment.

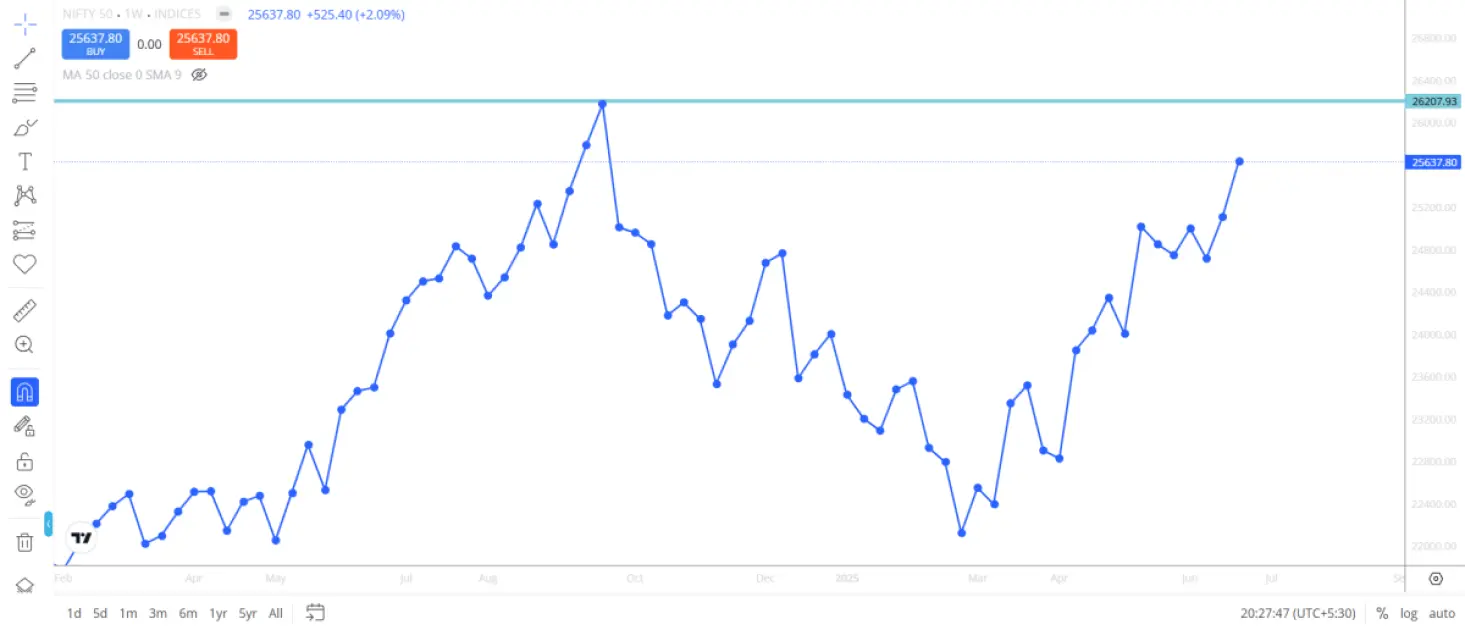

However, despite these positives, the market has not yet surpassed its September highs. Since then, it has moved sideways, consolidating within a range. One reason for this stagnation has been the lingering effects of the tariff policies introduced during the Trump administration, which created uncertainties for global trade, including India’s exports. Fortunately, these policies are now beginning to moderate, and the clarity emerging around trade terms is helping to improve investor confidence.

The Path Ahead: Trade Deals and Market Outlook

Looking forward, the most critical factor for the market’s direction will be the progress of trade negotiations between India and the USA. Key points emerging from these discussions, such as tariff reductions, trade balance commitments, and market access agreements, will have significant implications for investor sentiment.

Positive developments in these negotiations could provide a strong catalyst for the Nifty to break out of its current range and move towards new all-time highs. Conversely, setbacks or further geopolitical escalations could increase volatility and delay the next leg of the rally.

In conclusion, the Nifty’s trajectory in the coming weeks will hinge on a combination of easing geopolitical risks, supportive domestic monetary policy, and the outcome of crucial trade discussions with the USA. Encouraging signs from global rating agencies and favorable forecasts from international institutions add to the optimism, suggesting that if positive developments continue, the Nifty could soon challenge and surpass its previous record highs.

Investors should closely monitor key indicators such as inflation data, RBI policy announcements, global crude oil prices, and updates on trade negotiations. These will be pivotal in determining whether the market can sustain its current momentum and reach new milestones in the near future.

1 thought on “Nifty Outlook 26,300: Bulls Eye Fresh All-Time Highs”