Zomato has recently rebranded itself as Eternal Limited, reflecting its broader vision beyond just food delivery. As the Indian economy grows and consumer purchasing power increases, it creates a positive impact on businesses like Eternal. With India’s GDP forecast expected to grow above 6.5%, the outlook remains highly optimistic for the consumption-driven sectors. Eternal holds a strong market presence, being a leading player in both food delivery and quick commerce, which positions the company well to benefit from India’s rising economic momentum and evolving consumer lifestyle.

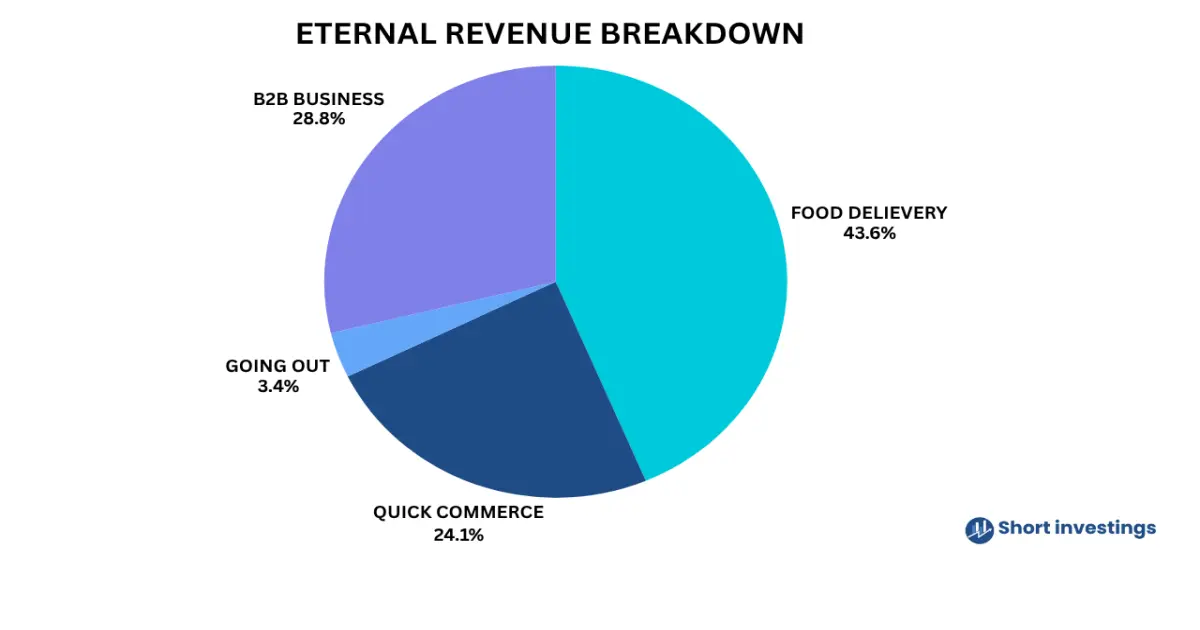

How ETERNAL makes money

Food Delivery segment

Eternal Business oldest and most established business — continued to deliver strong, sustained growth in FY25. Serving customers across 800+ cities in India, the platform recorded an impressive ₹32,862 crore in revenue for November, reflecting a 20% YoY increase.

This performance is firmly volume-driven and supported by deep market penetration. Customers placed a massive 853 million orders (+13% YoY), fuelled by an expanding base of 20.6 million average monthly transacting customers (+12% YoY). The steady rise in users and ordering frequency signals growing consumer purchasing power and increasing dependence on the platform.

To support this rising demand, the ecosystem has been scaling aggressively. The platform now engages 473k average monthly active delivery partners (+18% YoY) and 297k average monthly active restaurant partners, marking the strongest growth at +20% YoY. Additionally, the Net Average Order Value (NAOV) increased by 6% to ₹385, indicating healthy value growth alongside volume gains in a mature and highly competitive market.

Quick commerce business

The Quick Commerce segment is witnessing explosive growth, firmly establishing itself as one of the fastest-growing business categories with a highly promising future. Financial performance has been exceptional, with revenue for November soaring to ₹22,371 crore, marking a massive 113% year-on-year (YoY) jump. This surge is primarily volume-driven, as total orders climbed to 424 million, reflecting 108% YoY growth. The customer base is expanding at an equally impressive pace, with 10.2 million average monthly transacting customers, doubling 100% YoY, highlighting strong market penetration and consumer adoption.

Although the Net Average Order Value (NAOV) increased moderately by 2% to ₹528, the company’s key focus has been rapid offline expansion. It added 775 new stores, taking the total to 1,301 stores as of March 2025, now serving consumers across 100+ cities. This aggressive scaling, combined with rising user engagement, positions the Quick Commerce vertical as a powerful growth engine — significantly contributing to the company’s long-term “eternal” growth story and overall market leadership.

Going out business

Historically centered on Dining-out and small internal events (like Zomato Live), the business was massively expanded in FY25 through the acquisition of Paytm’s entertainment ticketing business. This move transformed “Going-out” into a comprehensive platform that now handles discovery, reservations, and transactions across multiple outdoor experiences. This includes Dining-out, Movies (partnering with major chains like PVR Inox and Cinepolis), Sports (with exclusive IPL access), and Events (concerts, theatre, comedy shows). All these services are now unified and delivered through the newly launched District app.

The FY25 Going-out highlights showcase major event partnerships, including being the exclusive ticketing partner for the Dil-Luminati Tour and the movie Pushpa (The Rule Part 2). They also sold $1.1$ million tickets as the exclusive IPL 2025 partner. Key owned and hosted events included the Feeding India Concert (Dua Lipa), the Dining Carnival for exclusive deals, and their original IP event, Zomaland.

Hyperpure – B2B Supplies

Hyperpure operates on an inventory-led (IP) model, supplying high-quality food ingredients and essential products primarily to restaurants. By sourcing directly from farmers and trusted suppliers, the business controls the end-to-end supply chain — ensuring consistent quality, competitive pricing, and reliable delivery. In addition to serving restaurants, Hyperpure also sells fresh food staples to third-party sellers on the Blinkit marketplace, strengthening its ecosystem presence.

The FY25 performance reflects strong scale and momentum. Hyperpure recorded ₹6,196 crore in revenue, delivering an impressive 95% YoY growth. The business now serves 100,000+ unique outlets (+30% YoY) and operates 11 warehouses across 8 cities, supporting its rapid expansion and growing nationwide footprint.

How ETERNAL business make expenses

The strong surge in Food Delivery revenue (up 20% YoY to ₹32,862 crore) and the explosive growth in Quick Commerce (up 113% YoY to ₹22,371 crore) remain the company’s core growth catalysts. This rapid scale-up naturally led to a sharp increase in the Cost of Goods Sold, which jumped from ₹2,882 crore to ₹5,565 crore, driven by the significantly higher inventory and operational capacity required to serve 853 million food orders and 424 million quick commerce orders.

Additionally, the 4× transaction growth in the acquired Going-out/Entertainment segment contributed to a steep rise in Other Expenses, which increased from ₹7,531 crore to ₹11,483 crore, reflecting higher spending on marketing, logistics, partner commissions, and platform support for millions of new transactions.

At the same time, Employee Benefits Expense increased from ₹1,659 crore to ₹2,558 crore, alongside higher depreciation costs—both indicating deeper investments in talent and physical infrastructure such as quick-commerce dark stores, delivery logistics, and B2B Hyperpure facilities. These elevated costs collectively reflect the heavy groundwork needed to support a multi-segment, high-velocity expansion strategy.