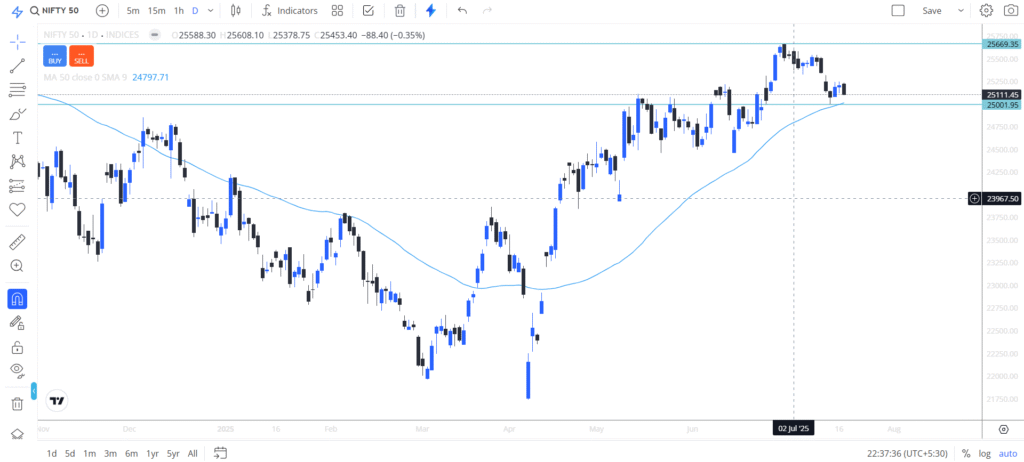

The market is consistently moving sideways, as Nifty made a nearly 100-point downside move today due to facing resistance around the 25,200 level.

The market is waiting to see how the trade negotiations from the Indian side are progressing with the USA. Any potential outcome from these talks is what the market is currently anticipating for the near future.

News Analysis

Trump on trade negotiations with India and other partners

Recently, Trump announced that India is moving toward an agreement similar to the one signed with Indonesia. This week, Indonesia signed a deal with the USA that allows the U.S. access to its markets, and in return, Indonesia will pay nearly 19% tariffs on exported goods to the USA. In contrast, Trump stated on his Truth Social app that there will be no such tariffs imposed on U.S. goods under the agreement.

Now, this is very important, as India’s minister has repeatedly stated that they are not going to allow access to India’s dairy sector. Also, the 19% tariff on dairy is not considered a major win for the Indian side. This is a key issue, as trade negotiations are still ongoing, and the market is likely to react to the outcome once it becomes clear.

Regarding major trade partners like the European Union, Canada, and Mexico, talks between these countries and the U.S. are still ongoing, as stated by Trump. Yes, tariff letters have been sent to these countries, but negotiations are still in progress. This suggests that significant changes could occur before the August 1 deadline.

At the same time, Trump has stated that they are planning to send 10% to 15% tariff letters to nearly 150 countries. This is also an important and significant development, according to sources.

Additionally, according to news outlets, a member of Japan’s trade negotiation team is expected to meet with U.S. Treasury Secretary Scott Besant. This is another key development in the ongoing trade negotiations between the U.S. and Japan.

There is no official process to remove Jerome Powell

In response to a reporter’s question, Trump stated that they have no plans to fire Federal Reserve Chair Jerome Powell. This comes amid speculation that Powell might be removed by the U.S. administration, and that a process could be underway to replace him, with several potential candidates reportedly in line. However, Trump has denied these claims, saying they have no such plans.

Meanwhile, the recently released inflation data showed a rise of nearly 2.7%, which was higher than expected. This adds to the uncertainty surrounding future Federal Reserve policy.

Fitch says Indian banks’ NIM may fall by 30 basis points

In a recent report, Fitch Ratings stated that Indian banks’ net interest margins may decline by 30 basis points in the financial year 2026. This is significant, as higher interest rate policies have already led to weaker quarterly results for Indian banks in the past, and similar performance is expected going forward.

As interest rates begin to decline, the impact on banks is likely to be gradual and part of a long-term trend, rather than a sudden shift. Fitch’s forecast of a 30 basis point decline reflects this expectation. This would also significantly affect the profitability of banks.

Trade talks continue with Peru and Chile

India is set to hold a second round of talks with Peru and also with Chile. These will be formal discussions, following previous talks between India and Peru. This is significant, especially because Chile has substantial lithium reserves, which are important from the perspective of electric vehicles (EVs). The first round of talks has been concluded, and the second round is scheduled to begin in Peru in August.

Nifty 50 technical analysis outlook

The market is moving sideways within a very narrow range. However, several factors could impact its future direction, including key technical levels and the upcoming Q2 earnings, as major companies are set to announce their quarterly results. Additionally, trade negotiations appear to be progressing well, and a near-term deal may be seen soon.

From a technical perspective, there is strong support around the 25,000 level, which is also aligned with the 50-day moving average on the daily chart. On the resistance side, the market may face hurdles around the 25,700 level in the near future.

Conclusion

The market is currently in a sideways phase due to pressure from Q2 earnings and the fact that trade negotiations have not yet been concluded. All these factors are crucial, especially the outcome of the trade talks and how competing countries with India are impacted by tariffs.

If those countries face higher-than-expected tariffs, it could potentially benefit India. However, if they secure deals with lower tariffs, it may pose a challenge. These developments will be important in the coming times, as they are key concerns directly related to business and market sentiment.